How to open NRO account in a Bank?

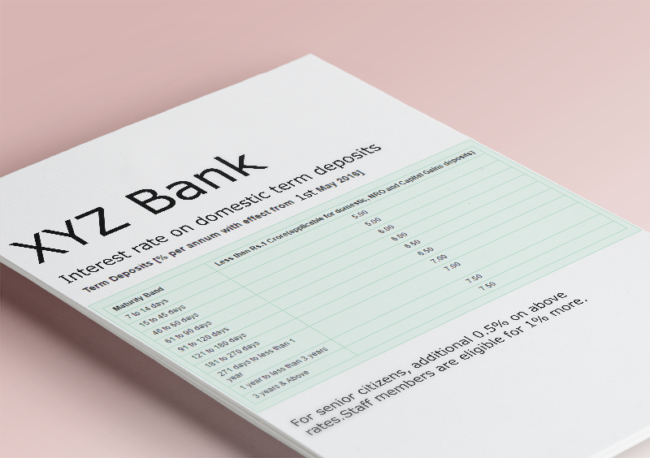

A Non-Resident Ordinary (NRO) Account is required by many Non-Resident Indians (NRIs) to manage their deposits or income earned in India such as dividends, pension, rent, or to credit sale proceeds of immovable properties in India, etc.This account also allows you to remit funds from abroad either in Indian or foreign currency. You have to…