CASA stands for Current Account and Savings Account in banking parlance. Besides in India, the term CASA is popularly is used in West Asia and South-east Asia countries.

The difference between the average yield of interest obtained from loans and the average rate of interest paid for deposits and other such funds (or the cost of funds) is called the net interest spread, and it is an indicator of a financial institution’s profit. The above type of deposits are lower cost deposits of the bank as banks do not pay interest on current account and the interest on saving accounts is usually very low 3-4%. Therefore it is important for all the banks to maintain high rate of CASA ratio to earn good profit.

The CASA ratio is calculated by dividing CASA deposit/ Total deposit( Casa Deposit÷ Total Deposits). A higher CASA ratio indicates a lower cost of funds, because banks do not usually give any interests on current account deposits and the interest on saving accounts is usually very low 3-4%

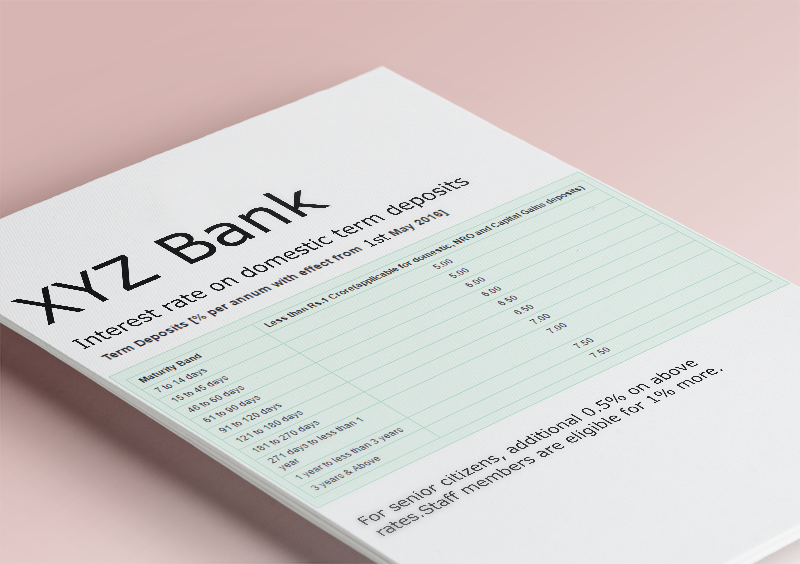

Bulk Deposits/High cost deposits: The high-cost deposits or bulk deposits as defined by the Finance Ministry of Inda, as ‘the deposits which are solicited by banks at rates higher than card rates’. Card rates are those published by banks for various kinds of deposits’.