A credit can be categorized into several types, with the most common being revolving credit, installment credit, and open credit. Revolving credit, like credit cards, allows for repeated borrowing and repayment up to a limit. Installment credit involves borrowing a fixed amount with a set repayment schedule, such as an auto loan. Open credit, like store credit accounts, allows for ongoing borrowing and repayment.

A credit instrument is a written document that serves as evidence of a debt, such as a bill of exchange, promissory note, bond, loan, cheque, or invoice. These instruments are widely used in both personal and commercial finance, forming the backbone of credit transactions. Understanding the types of credit instruments is essential for lenders, borrowers, and financial professionals to ensure effective financial planning and legal compliance.

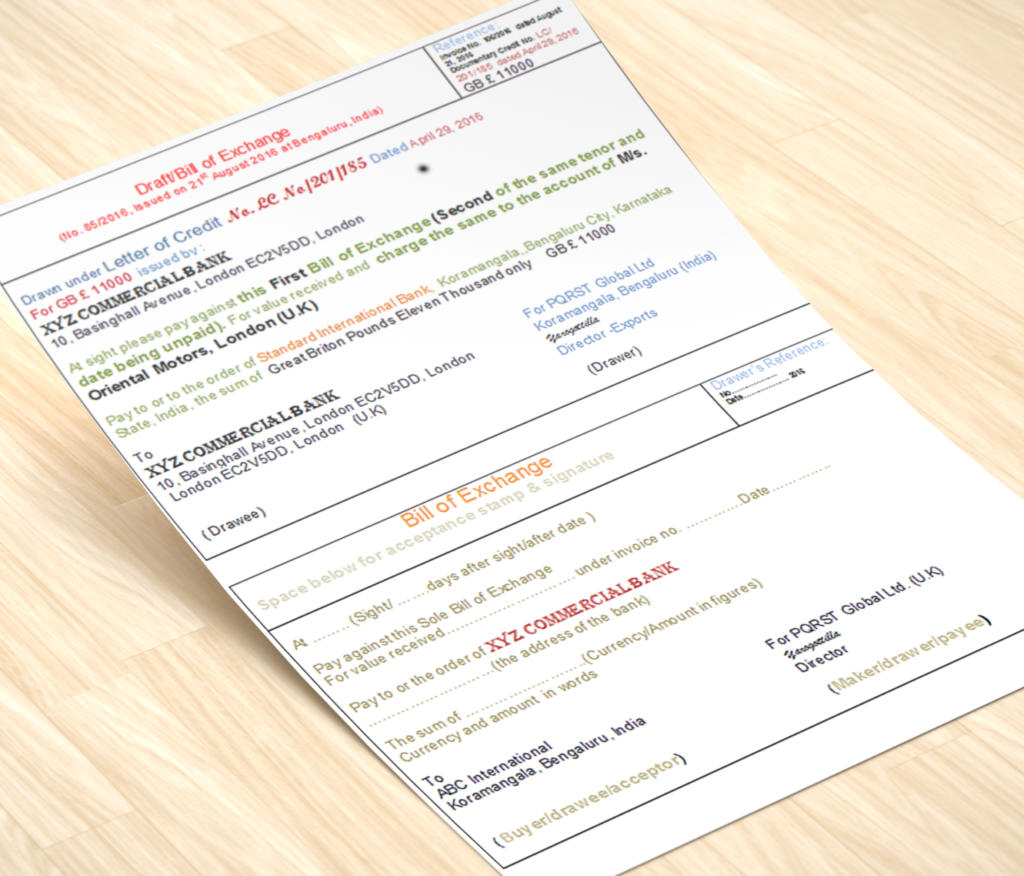

Bill of Exchange:

A Bill of exchange is a written, unconditional order by one party (the drawer) to another party (the drawee) to pay a specified sum of money to a third party (the payee) at a predetermined date or on demand. The bill of exchange serves as a promise to pay and acts as a credit instrument, providing security and trust in transactions.

There are many types of bills of exchange, including:

Sight bill: A sight bill, also known as a sight draft, is a bill of exchange that must be paid immediately or within a set date upon presentation. In the bill of exchange, the exporter/Seller holds the title to the transported goods until the importer/buyer receives and pays for them.

Time bill of exchange: Payable on a set date, not on demand

Usance bill of exchange: Payable after a set period, usually several months

Time bill: A bill that is payable on a set date in the future.

Usance bill: A bill that is payable after a set period, usually several months. In the case of usance bills, credit can be granted for a maximum duration of 365 days from the date of shipment inclusive of the Normal Transit Period (NTP) and grace period, if any. However, banks should closely monitor the need for extending post-shipment credit up to the permissible period of 365 days and they should persuade the exporters to realise the export proceeds within a shorter period. (Source: RBI Master Circular).

‘Normal transit period’ means the average period normally involved from the date of negotiation/purchase/discount till the receipt of bill proceeds in the Nostro account of the bank concerned, as prescribed by FEDAI from time to time. It is not to be confused with the time taken for the arrival of goods at an overseas destination.

Trade acceptance bill: When a draft is drawn on a Buyer/Drawee it’s considered a Demand for Payment. When “Accepted” by the Buyer/Drawee it becomes a Trade Acceptance. Most countries have common laws governing Trade Acceptance (typically covered by negotiable instrument law).

Accommodation bill: A bill created to facilitate financial assistance to a third party, such as a friend or family member without being backed by any trade transactions.

Documentary bill: A bill that is accompanied by supporting documents that verify the transaction between the buyer and seller.

Inland bill: A bill that is only due in the country to which it is issued.

Clean bill: A bill that has no attached documents, so it has a higher interest rate than other types of bills.

Bank draft: A bill of exchange issued by a bank, where the issuing bank guarantees payment.

Trade draft: A trade draft is a type of draft that is used in commercial transactions. Generally, when a company purchases goods from another company, it may use a trade draft to pay for the goods. The trade draft would instruct the company’s bank to pay the amount specified to the seller or the seller’s bank.

Promissory note: A bill of exchange where the drawer makes an unconditional promise to pay the payee a specified sum of money.

Cheque: A cheque is a type of bill of exchange that contains an unconditional order to the drawee to make a payment to the payee on behalf of the drawer. A bill of exchange is a financial instrument that can be used for payment, and a cheque is a specific type of bill of exchange that is drawn on a bank. The three parties involved in a cheque transaction are the drawer, the drawee, and the payee.

Credit Card: A credit card is a plastic card issued by a financial institution that allows the holder to borrow funds to pay for goods and services, with an obligation to repay the amount along with applicable interest and fees within a stipulated period.

Overdraft Facility: An overdraft allows a bank customer to withdraw more money than what is available in their account, up to an approved limit. It is a flexible form of short-term borrowing, subject to interest on the overdrawn amount.

Letter of Credit (LC): A letter of credit is a document issued by a bank guaranteeing a buyer’s payment to a seller will be received on time and for the correct amount. It is frequently used in international transactions to reduce payment risk.

Loan Agreement: A loan agreement is a legally binding contract between a borrower and a lender that outlines the terms and conditions of a loan, including the amount, interest rate, repayment schedule, and default consequences.

Conclusion:

Each credit instrument serves a distinct purpose and carries specific legal and financial implications. Familiarity with these instruments empowers stakeholders to choose appropriate tools for different credit needs and ensures smooth and transparent credit transactions. In professional practice, selecting the right instrument depends on the nature of the transaction, the relationship between parties, and the associated risk factors.

Related Posts: