The Importance of Credit in Personal, Business, and Economic Development

Introduction Credit plays a pivotal role in contemporary financial systems, serving as a key enabler for individuals and businesses to access funds for a wide range of purposes—from everyday purchases to large-scale investments. It acts as a catalyst for economic activity by supporting both consumption and production. Moreover, a strong credit profile and prudent credit…

Read articleUnderstanding the types of credit and the credit instruments

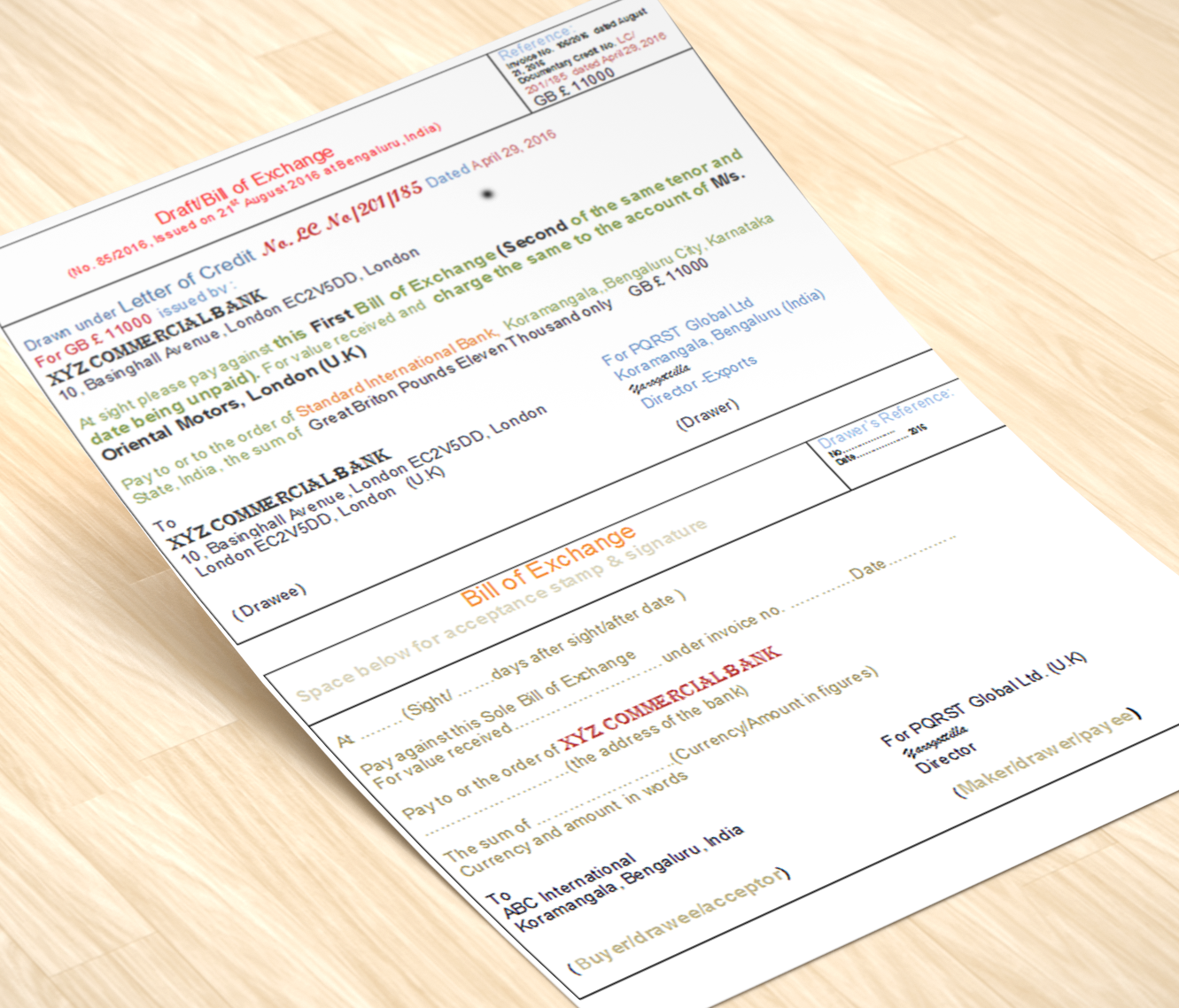

A credit can be categorized into several types, with the most common being revolving credit, installment credit, and open credit. Revolving credit, like credit cards, allows for repeated borrowing and repayment up to a limit. Installment credit involves borrowing a fixed amount with a set repayment schedule, such as an auto loan. Open credit, like…

Read articleOverview: Strategic Credit Management: Principles, Policies, and Practices

Credit management refers to the structured process of granting, monitoring, and recovering credit extended to customers. It involves evaluating the creditworthiness of potential borrowers, setting appropriate credit limits, and managing receivables to minimize financial risk and maintain optimal cash flow. Sound credit management is essential for sustaining a business’s financial health and nurturing long-term customer…

Read articlePrinciples of Lending: Comprahensive framework and practice

The principles of lending revolve mainly around the concepts of safety, profitability and liquidity of advance. The criteria for lending get changed or modified from time to time in response to changing the state of the economy. Traditionally commercial banks in India used to provide security oriented finance to trade and industry. Big industrial houses…

Read articleCredit administration: Routines of a Bank Manager

The loan and advances made by a bank shall be utilized for the recognized purpose and the fund is effectively recycled. As a business partner, your bank is also a stakeholder in the business performance of his borrower. This is because the investment made by the borrower through the bank finance shall bring income both…

Enhancing Credit Flow to SC/ST Beneficiaries under Major Centrally Sponsored Schemes

The Reserve Bank of India (RBI) has periodically issued comprehensive guidelines and instructions to banks to promote the flow of credit to Scheduled Castes (SCs) and Scheduled Tribes (STs). In order to facilitate greater participation of SC/ST beneficiaries in availing credit facilities, it is imperative to enhance awareness of various schemes through effective communication strategies…

Read article