Deposit of TDS to the Income Tax Department by Banks

Introduction to TDSTDS stands for Tax Deducted at Source. It is a mechanism introduced to collect tax at the very origin of income. Under this system, a person (referred to as the deductor) responsible for making specified payments to another person (the deductee) is required to deduct tax at the source and deposit the same…

Read articleOperational Guidance on Premature Withdrawal of Fixed Deposits (FDs)

Premature withdrawal refers to the closure of a Fixed Deposit (FD) before its maturity date. While depositors may opt for early withdrawal due to unforeseen financial needs, such actions typically attract a penalty, which is generally a deduction from the interest earned on the deposit. General Penalty Structure Most banks impose a penal interest—usually ranging…

Read articleUnderstanding Time Deposits, Operational Instructions, and Interest Payments

A time deposit is a type of bank account that earns interest on the condition that the funds remain deposited for a predetermined period. The term “periodicity” in the context of time deposits refers to the specific duration for which the funds are committed. This term can range from as short as 7 days to…

Read articleRBI Regulations: Interest paid on various types of deposit accounts

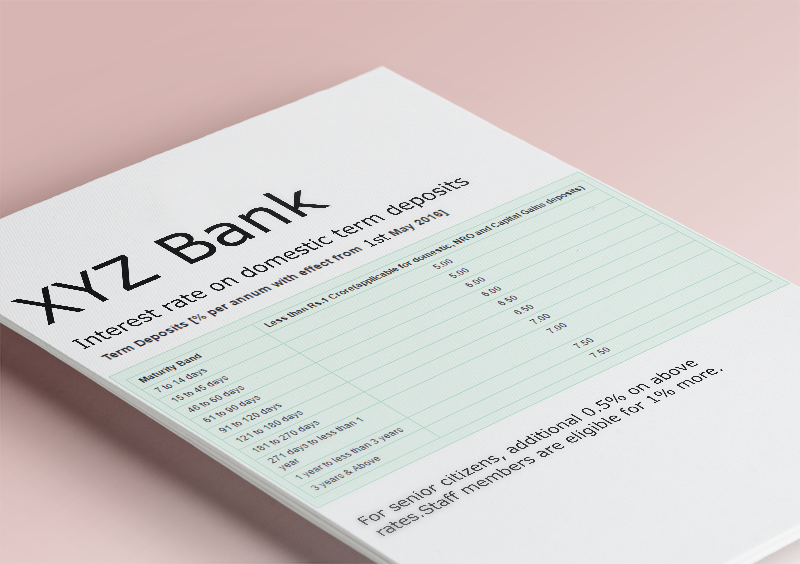

This post elucidates how interest rates offered by banks may vary based on the tenor of deposits, the Periodicity of interest payable on SB accounts, accounts frozen by enforcement authorities, and floating deposits. Additional rate of interest paid by banks in certain cases, interest payable on NRE and FCNR (B) deposits, rules regarding interest payable…

Read articleLoan and advances against fixed deposit/term deposit

A loan against a term deposit, also known as a loan against a fixed deposit (FD), is a secured loan that allows bank depositors to borrow against the security of the deposits. Loans or cash credit limits can be availed against Fixed Deposits, or Cash Certificate and Recurring deposits. Loans can be availed against domestic…

Tax saving fixed deposits: Dual benefit of tax saving with assured interest

An individual or HUF who has opted for the old income tax rule can invest in Tax saver fixed deposits of banks, not exceeding the aggregate limit of Rs.150000.00 u/s 80 (C) of IT in a financial year is eligible for tax relief. The ‘deposit’ can be opened in a single name or joint names…

Read article