Understanding Documentation Procedure and stamping in Banks

It is inevitable for banks to ascertain that bank could easily take possession of such security based on documents obtained from the borrower with very little expenses and dispose-off the same to recover its dues when the account goes bad. Banks obtain ‘Different Types of Documents‘ from the borrower based on the type of security…

Read articleUnderstanding different types of legally enforceable documents

A legal document is a written agreement between two or more parties that can be relied upon in court. They can be used to establish contractual relationships, grant rights, or provide evidence for legal obligations. It is inevitable for banks to ascertain that they could easily take possession of such security based on documents obtained…

Read articleHow to get home loans: Procedure and Practices for Home Loans

Banks and non-banking financial institutions lend for purchase or construct a new home. For a smooth home loan (also known as housing loan in some banks) process, the prospective borrower must submit a duly filled application along with important documents such as identity proof, address proof, income proof, etc. If there is a co-borrower they…

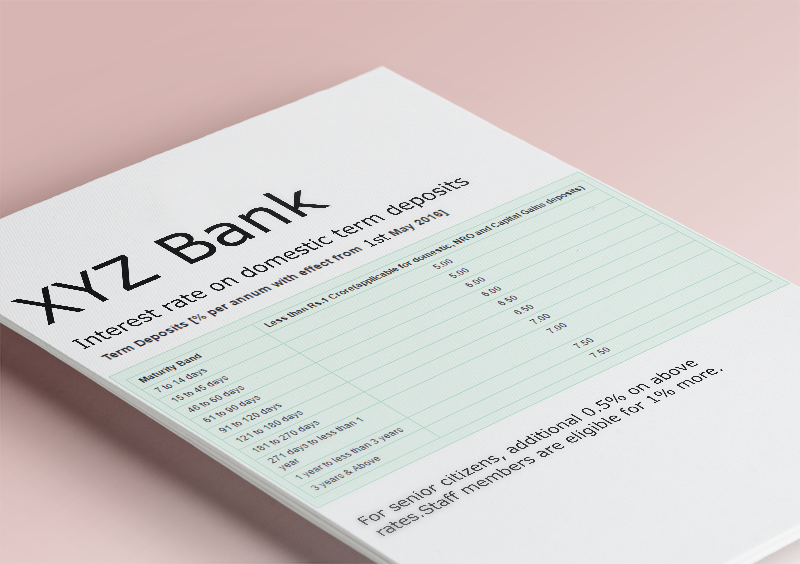

Read articleRBI Regulations: Interest paid on various types of deposit accounts

This post elucidates how interest rates offered by banks may vary based on the tenor of deposits, the Periodicity of interest payable on SB accounts, accounts frozen by enforcement authorities, and floating deposits. Additional rate of interest paid by banks in certain cases, interest payable on NRE and FCNR (B) deposits, rules regarding interest payable…

Read articleLoan and advances against fixed deposit/term deposit

A loan against a term deposit, also known as a loan against a fixed deposit (FD), is a secured loan that allows bank depositors to borrow against the security of the deposits. Loans or cash credit limits can be availed against Fixed Deposits, or Cash Certificate and Recurring deposits. Loans can be availed against domestic…

Meaning of different operation mandates in Joint accounts

Joint accounts are accounts that are in the name of two or more persons. The operation instructions in joint accounts in banks like ‘either or survivor’, former/latter or survivor’, ‘anyone or survivor’, ‘both or survivor’, or ‘all or survivor’ are actually a mandate given by the joint holders of the account. Every above operation instructions…

Read article