Interest rates on bank deposits vary across institutions in India. To help you stay informed, we’ve compiled the latest deposit interest rates offered by all public sector banks and leading private sector banks.

In the lists below, banks are arranged alphabetically under their respective categories —Public Sector Banks and Private Sector Banks.

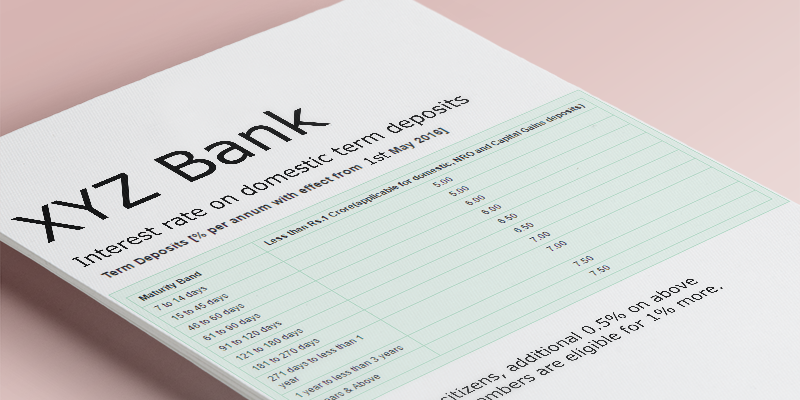

Next to each bank’s name, you’ll find a **comparison table** showing current rates on **callable domestic deposits below ₹3 crore for tenures of 1 year, 2 years, 3 years, 5 years, and above 5 years. These figures are **regularly updated** for your convenience.

Most banks also offer additional interest rates for senior citizens, and in some cases, super senior citizens (aged 80 years and above).

👉 Click on a bank’s name to visit its official website and view the latest detailed interest rate structure** for all types of deposits, including domestic fixed deposits.

| Public sector Banks as of 22.10.2025 interest rate in percentage per annum |

| Bank’s Name | 1 Year | 2 Years | 3 Years | 5 Years | 5+ Years | Special rates |

| Bank of Baroda | 6.25 | 6.50 | 6.50 | 6.40 | 6.00 | 400 days 6.50 |

| Bank of India | 6.25 | 6.30 | 6.25 | 6.00 | 6.00 | 777 days 6.60 |

| Bank of Maharashtra | 6.20 | 6.20 | 6.20 | 6.10 | 6.10 | |

| Canara Bank | 6.25 | 6.25 | 6.25 | 6.25 | 6.25 | 444 days 6.50 |

| Central Bank | 6.40 | 6.50 | 6.25 | 6.25 | 6.25 | |

| IDBI Bank | 6.55 | 6.55 | 6.55 | 6.55 | 5.95 | |

| Indian Bank | 6.10 | 6.40 | 6.25 | 6.00 | 6.00 |

444 days 6.90 555 days 6.80 |

| I.O.B | 6.60 | 6.50 | 6.20 | 6.20 | 6.20 |

444 days 6.75 Green deposit : 999 days 6.70 |

| Punjab National Bank | 6.25 | 6.40 | 6.40 | 6.25 | 6.0 | |

| Punjab & Sind Bank | 6.00 | 6.10 | 6.00 | 6.10 | 6.00 | 444 days 6.60 |

| UCO Bank | 6.25 | 6.20 | 6.15 | 6.10 | 6.00 | 444 days 7.05 |

| Union Bank | 6.40 | 6.50 | 6.60 | 6.40 | 6.40 | |

| State Bank of India | 6.25 | 6.45 | 6.30 | 6.05 | 6.05 |

Rate of interest (percent per annum) on term deposits of major private sector banks -at a glance.

Last Updated on 22.10.2025

|

Bank’s Name |

1 Year |

2 Years |

3 Years |

5 Years |

5+ Years |

As appeared on the official websites of the respective banks as of 22.10.2025 |

|

6.25 |

6.60 |

6.60 |

6.60 |

6.60 | ||

|

6.90 |

6.90 |

7.00 |

7.00 |

7.00 |

||

|

6.50 |

6.60 |

6.50 |

6.50 |

6.50 |

999 days 6.70% | |

|

6.30 |

6.40 |

6.40 |

6.25 |

6.25 |

||

|

6.25 |

6.45 |

6.45 |

6.40 |

6.40 |

||

|

6.25 |

6.40 |

6.60 |

6.60 |

6.60 |

||

|

6.60 |

6.75 |

6.75 |

6.50 |

6.50 |

888 days 7.10% | |

|

6.50 |

6.65 |

6.40 |

6.15 |

6.15 |

555 days 6.65% | |

|

6.55 |

6.55 |

6.55 |

6.55 |

6.25 |

||

|

6.50 |

6.40 |

6.40 |

6.25 |

6.25 |

||

|

7.00 |

7.20 |

7.20 |

7.00 |

6.70 |

||

|

6.10 |

6.20 |

6.20 |

5.70 |

5.70 |

Green deposit for 66 months : 6.00% | |

|

6.65 |

7.00 |

7.00 |

6.75 |

6.75 |

Disclaimer: Public Sector Banks are the banks where the Government of India has the majority capital stake and in Private Sector Banks, the private promoters and the general public are the shareholders. This website neither recommends the readers put their deposit in any specific bank nor take any responsibility, in the event of a bank failing or going into liquidation or reconstructed or amalgamated, or merging with another bank.

As interest rates are subject to change without prior notice, the depositor shall ascertain from the concerned bank, the rates on the value date of FD. Readers/bankers/financial institutions may inform us about updates, corrections or any inclusions to be made in this post. Banks at their discretion offer additional interest to the resident senior citizens (of age 60 years and above), over and above the rate of interest admissible to the general public. (Example: plus 0.25% p.a., 0.40% p.a., plus 0.50% p.a., maximum up to plus 1.00%). At present, most banks offer 0.50% additional interest to Senior citizens over and above the rate of interest admissible to the general public. Senior Citizens are therefore required to check the additional interest offered to them by the concerned bank before depositing their money.

- Subsidiary vs Sister vs Associate vs JV vs Conglomerate: Key Corporate Structures Explained

- Union Budget 2026: How the TCS Reduction Benefits Students

- Union Budget 2026 — What Banks and Taxpayers Need to Know

- Union Budget 2026: Key Takeaways for Banking Sector

- Bank Pensioners Dearness Rate from February to July 2026

Please prefer Lakshmi Vilas Bank Interest rates in this site also. They are giving High Rate Of Interest on Savings and Term Deposits..

O.K. noted

I’m not able to track the official website of the LVB for deposit rate. If possible send me the link.

This bank has been merged with DBS bank

I am SEP 1998 VRS pensioner of Canara Bank with BP Rs.7069/. What will be my pension for Feb 2018.

(2) What is the position of Bank Pensioner after recent Supreme court’s judgement?

Thanks, Regards. SBM

Sir, RAte of interest of O.B.C. needs correction.

Thank you, sir. I have changed the rate, as well as revised URL of the new official website.Thanks once again and regard.

had given a personal guarantee of a corporate loan.Does the personal loan needs to be renewed after a year or after a certain period or it is limitless till the company or i am alive.

It depends purely on the terms of the guarantee contract. However, if you decide to opt out, you will have to approach the lender directly with an application. Unfortunately, the discretion is solely dependent on the lender whether or not it will let you go. You may also approach the bank with an application for a release if there is a substitute guarantor for the loan. If the bank is really convinced why you are opting out and is convinced about the credentials of the substitute borrower, it may set you free. For limitation period of personal guarantee click and read the following link

http://86x.efb.mytemp.website/loans-and-advances/how-to-compute-period-of-limitation-for-personal-guarantees/