The Reserve Bank of India (RBI) has issued updated directions (2025) governing how commercial banks must set and pay interest on domestic deposits, NRE/NRO deposits, and FCNR(B) deposits. The circular emphasises transparency, uniformity, and customer protection.

1. Uniform, Transparent Interest-Rate Framework

– Board-approved interest-rate policy.

– Uniform, non-discriminatory rates across branches.

– No negotiated rates; only published schedule.

– Bulk deposit rate card must be maintained.

– Rounded-off interest: nearest rupee (INR), two decimals (FCNRB).

2. Deposits Maturing on Non-Business Days

– Interest at contracted rate for all intervening non-business days.

– Applies to commercial and co-operative banks.

– Reinvestment/recurring deposits: interest on maturity value.

3. Transfer of Branches Between Banks

– Deposit terms continue unchanged.

– Same interest rate payable till maturity.

Domestic Rupee Deposits

4. Current Accounts

– No interest.

– Exception: deceased accounts earn savings rate until settlement.

5. Savings Accounts

– Daily product method.

– Uniform rate up to ₹1 lakh; differential above ₹1 lakh.

– Interest credit: quarterly/shorter (commercial), quarterly/longer (co-op).

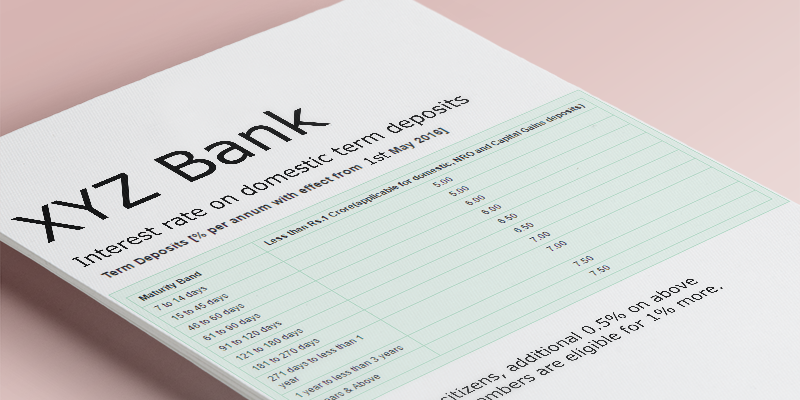

6. Domestic Term Deposits

– Rates vary by tenor, size (bulk), and premature withdrawal option.

– Minimum tenor: 7 days.

– Premature withdrawal: rate applicable to actual period; no interest if <7 days.

– Additional interest: up to 1% for staff/retirees and associations.

– Senior citizen schemes permitted.

– Overdue deposits earn lower of savings or contracted rate.

– Floating rate deposits must use transparent benchmarks.

7. Composite Cash Credit of Farmers

– Banks may pay interest on minimum balance (10th to month-end).

Non-Resident Rupee Deposits (NRE/NRO)

8. General

– Only authorised banks may accept NRE/NRO deposits.

9. Interest Structure

– Minimum tenor: NRE (1 year), NRO (7 days).

– Rates must not exceed domestic deposit rates.

– No senior citizen/staff additional interest.

10. Interest Credit Frequency

– Quarterly/shorter (commercial).

– Quarterly/longer (co-op).

11. Conversion to RFC

– If run < 1 year: interest ≤ RFC savings rate.

– Otherwise: contracted rate.

12. Premature Withdrawal

– No penalty for NRE→RFC conversion.

– Penalty applicable for NRE↔FCNR(B).

– No penalty in branch-transfer cases.

13. Deceased NRE Depositors

– Becomes domestic TD upon maturity for resident claimants.

Foreign Currency Deposits – FCNR(B)

14. General

– Only authorised banks under FEMA may accept FCNR(B).

15. Interest Structure

– Tenors: 1–<2, 2–<3, 3–<4, 4–<5, 5 years only.

– No recurring FCNR(B) deposits.

16. Ceiling Rates

– 1–<3 years: ARR/Swap + 250 bps

– 3–5 years: ARR/Swap + 350 bps

– Based on FBIL benchmarks.

Interest on the deposits accepted under the scheme shall be calculated on the basis of 360 days to a year

17. Floating Rate Deposits

– Reset every 6 months.

– Benchmark: ARR/swap of previous month-end.