The major characteristics of the RD account can be described as “a variant of term deposit offered by the banks with fixed monthly investment, fixed duration, and a fixed rate of interest throughout the tenure of the deposit”.

Under the scheme, the account holder has to deposit a pre-decided fixed amount every month to his recurring deposit account for a specific period. The minimum deposit per month accepted in public sector banks is Rs.100/- and varies from Rs.500 to Rs.1000 in private sector banks. The maturity value of the deposit will depend on the amount of investment, duration of the deposit and the interest rate. You can tweak your tenure between six months and ten years according to your target of savings. However, the tenure of the deposit and monthly installment once decided at the time of opening the deposit cannot be altered in the middle.

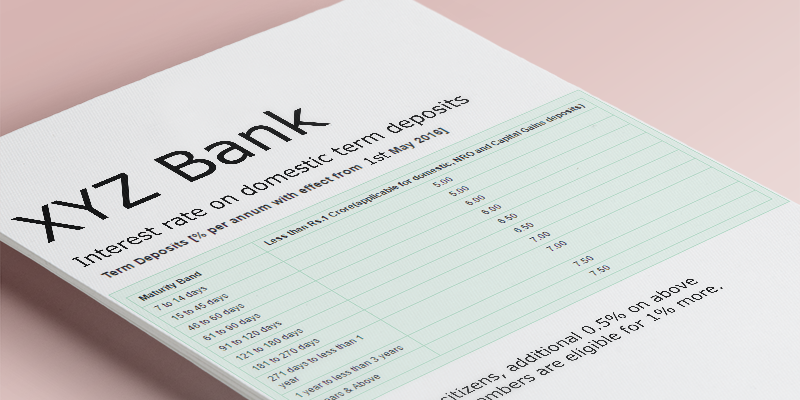

The interest rates for recurring deposits will be the same as the rate of interest applicable to Fixed Deposits offered by the particular bank. The interest on deposit will be calculated from the date of each monthly installment is paid using the compound interest formula on a quarterly basis. You can give a standing instruction to deduct the installment amount from your SB account/current account with the bank and credit the same to the RD account on a particular date matching with a date of opening the deposit.