A bad bank is simply an Asset Reconstruction Company (ARC) designed to absorb bad loans or NPA accounts of banks that are written off or deemed by banks as doubtful or lost assets. These are the assets against which banks have already set aside money by way of provisions to cover the losses. Banks sell such assets to Bad Bank at a steep discount ranging 15/20 percent of their value. This helps banks to clean of their balance sheet, thereby removing the uncertainty and the inefficiency that takes hold in a traditional lending model. Among other things, this frees up resources for fresh origination and reduces the need to hold capital against risk-weighted assets. From a governmental and regulatory perspective, a bad bank is a useful tool to clean up excessive NPA volumes, thereby reducing systemic risk in the economy and avoiding the need for the government to step in and potentially recapitalize banks, ultimately at the cost of the taxpayer.

The bad bank that bought those assets then tries to resolve these bad loan assets either by reviving or selling in parts to recover the maximum possible value. Banks receive 15 percent of the agreement value upfront in cash on sale of bad loans and 85 per cent of the balance amount in the form of a security receipt (SR). If the resolution extends beyond 5 years the government pays banks against the Security Receipt (SR).

The bad bank in India is known as NARCL (National Asset Reconstruction Company Ltd). NARCL a government entity was incorporated on 7th July 2021 with a majority stake (51%) held by Public Sector Banks and the balance by private banks with Canara Bank being the sponsor bank. It is registered with the Reserve Bank of India as an Asset Reconstruction Company under the Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest Act, 2002.

The Stressed Asset Resolution announced in India’s 2021-22 Union Budget proposed the establishment of a novel twin structure to clean up bank balance sheets in India. In this dual structure, the primary company, the National Asset Reconstruction Company Limited (“NARCL”), is a public sector asset reconstruction company mandated to acquire and aggregate non-performing assets (“NPAs”) (i.e. the ‘bad bank’). The second company is a private sector asset management company established to focus on the management and resolution of the NPAs held by NARCL, the India Debt Resolution Company Limited (“IDRCL”).

National Asset Reconstruction Company Ltd (NARCL) backed by Government acquires and aggregates bad loans from lenders while another organisation, India Debt Resolution Company Ltd (IDRCL), acting simultaneously as a private sector entity, focuses on the resolution of the non-performing assets for enhancing the value of the loans and finding a better suitor for the troubled borrowing company.

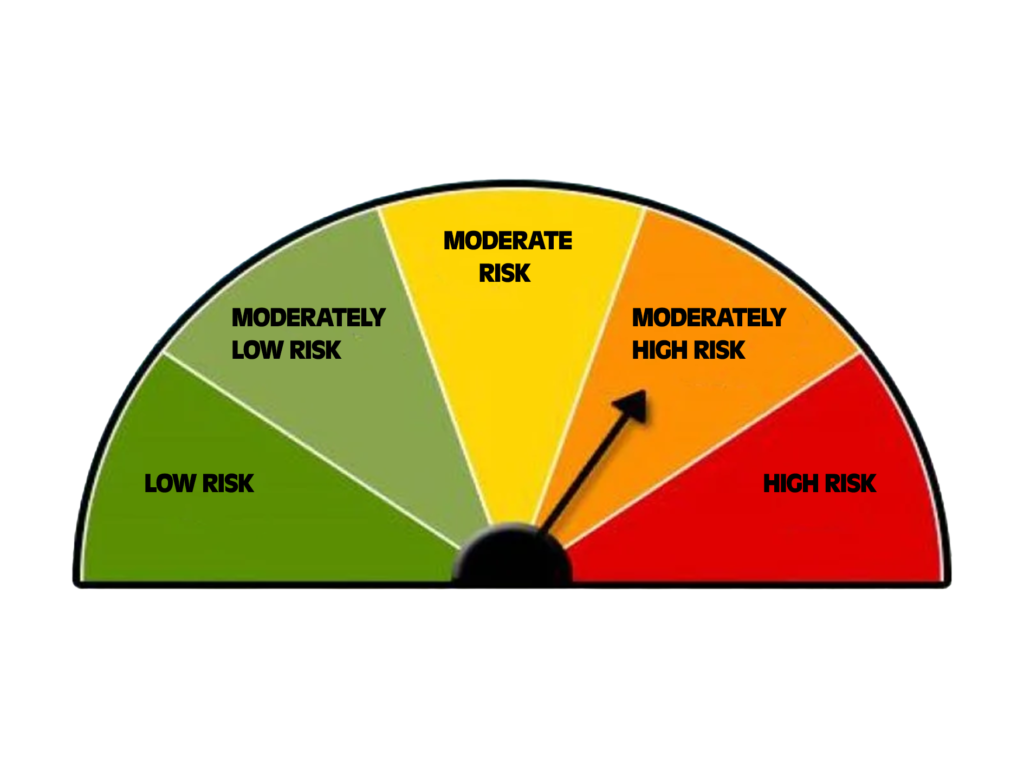

Banks have not seen attractiveness in selling their assets to NARCL as the significant discount to book value currently being attained in the market and the long lead time to recover value under SRs (or the government guarantee following a sub-optimal resolution of the NPAs). Since NPAs are bought at a fair market value, the value proposition may change as the market shifts and eventually sell to funds or other investors. There have also been other issues such as the placement of legal liabilities associated with the sale of fraudulent accounts between NARCL and selling banks and a pronounced turnover in NARCL’s leadership. Furthermore, pricing offered by other private ARCs in India is more competitive compared to NARCL.

Related Posts:

| DEFINITION OF BAD BANKS AND NARCL IN INDIA | WHAT IS THE INFRASTRUCTURE FINANCING? |

| THE NATIONAL BANK FOR FINANCING INFRASTRUCTURE AND DEVELOPMENT (NBFID) | BASIC CONCEPTS ON ‘EASE’ EXPLAINED |