Economists like Ricardo, J. S. Mill, Marshall, and Pigou developed the classical theory of interest which is also known as the capital theory of interest, the saving-investment theory of interest, or the real theory of interest. In the classical theory, the equilibrium rate of interest is the one that equals the supply of loanable funds to the demand for loanable funds. The main components of this theory are the role of savings (supply of funds) and investment (demand for funds) in determining the interest rate.

According to this theory, interest is a real phenomenon and the rate of interest is determined exclusively by the real factors, i.e., the supply of and demand for capital under perfect competition. The supply of capital is governed by thrift (i.e. saving) or time preference and the demand for capital is influenced by the productivity of capital.

Assumption of the classical theory is based on Perfect competition exists in the factor market:

(a) The equilibrium rate of interest is decided by the competitive forces of demand and supply in the capital market.

(b) Interest rate is flexible. It means interest rate moves freely to whatever level the demand and supply forces dictate.

The Assumption of the classical theory is based on the full employment of resources:

- When all resources are wholly employed, a higher rate of interest is paid to encourage people to save or abstain from consumption or postpone consumption.

- The income level is assumed to be constant.

- Demand and supply schedules of capital are independent and do not influence each other.

- Money is neutral and serves only as a medium of exchange and not as a store of value

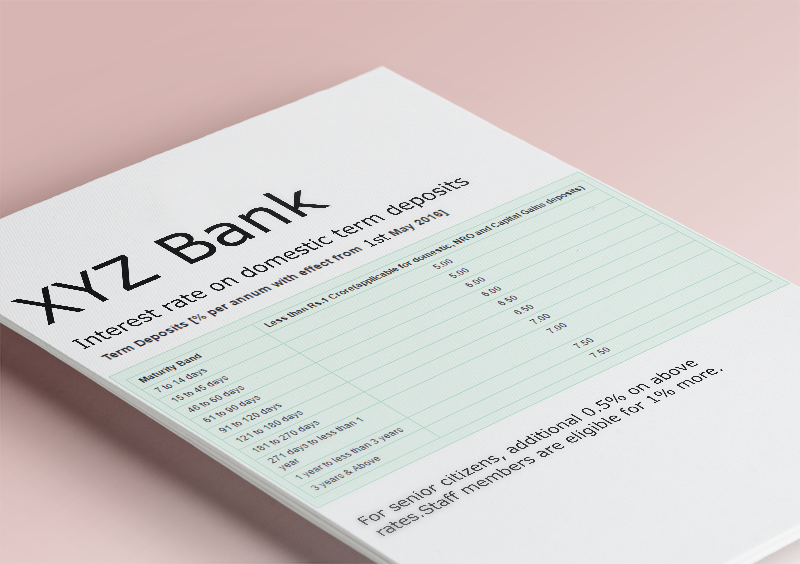

The Supply of Capital:

The supply of capital is built on savings which, in turn, are subject to several psychological, economic, and institutional factors broadly classified as – (a) the will to save, (b) the power to save, and (c) The facilities to save.

The Demand for Capital:

a) The demand for capital or investment demand is contingent on the productivity of capital, i.e., returns on investment, and the rate of interest (the cost of investment).

b) As long as the capital-output is more than the interest rate, the producer may continue his capital investment. He can stop further investment when the productivity of capital, equals the rate of interest.

Thus, the demand for capital is inversely related to the rate of interest

Related Posts;

2. HICKS-HANSEN SYNTHESIS: IS-LM CURVE MODEL