Union MSME Minister Narayan Rane on Thursday launched the revamped Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE) scheme. The modifications included a reduction in guarantee fees for loans up to ₹1 crore by 50% to the level of 0.37% per annum only. Another major change announced was raising of ceiling for the guarantee from ₹2 crores to ₹ 5 crores and enhancing the threshold limit for claim settlement without initiation of legal action to ₹10 lakh.

The Minister while launching the revamped scheme announced that the Government will provide a guarantee for additional ₹2 lakh crore loans and advances to the micro and small enterprises. The move comes in the wake of ₹9,000 crore allocations to the scheme in the Union Budget 2023-23 to revamp the scheme.

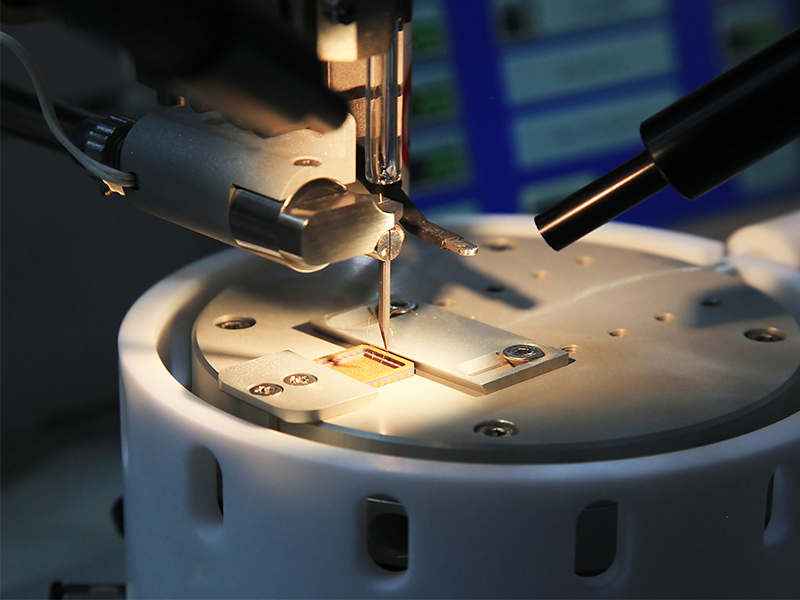

Mr.Narayana Rane impressed upon lending institutions to make the best use of liberalisation to ensure enhanced lending to the Micro and Small Enterprises (MSE) segment without insisting on collateral. He expressed confidence that such measures would enthuse bankers to reduce their dependence on the availability of collateral security which continues to be a problem for MSEs, especially the first generation entrepreneurs.

Finance, economics, and accounting are deeply interconnected disciplines that influence one another. A thorough understanding…

Introduction The organization of the finance function involves structuring financial roles, responsibilities, processes, and systems…

Business ethics involves managing values and resolving conflicts. It refers to the moral principles, policies,…

An agency problem in financial management refers to a conflict of interest between a company’s…

The risk-return trade-off is an essential investment principle that states that higher risk often comes…

The concept of Financial Building Blocks (FBB) serves as a powerful tool for understanding the…