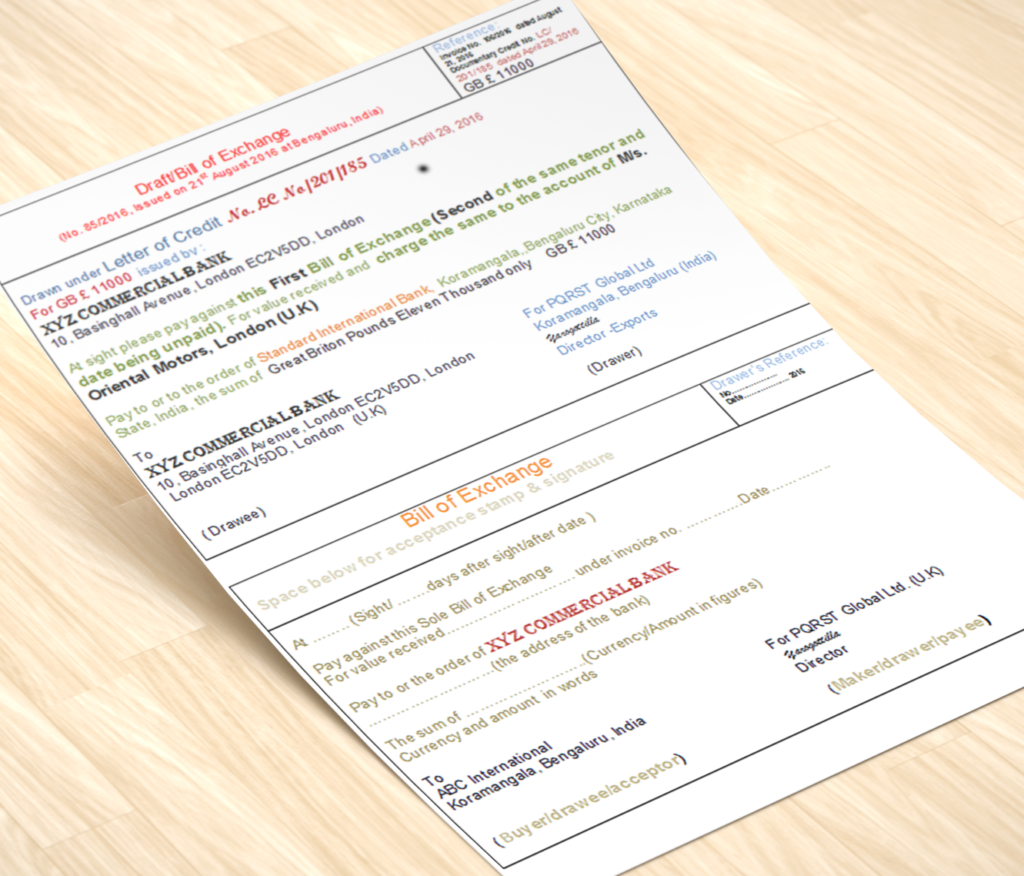

Bills finance is short term and self- liquidating finance in nature. Demand Bills are purchased and Usance bills are discounted and the bills drawn under Letter of Credit (LC may be on sight draft or usance draft) are negotiated by the banks. The advantage of bills finance is that the seller of goods (borrower) gets immediate money from the bank for the goods sold by him irrespective of whether it is a purchase, discount or negotiation by the bank according to nature of bills.

Demand bills can be documentary or clean. The demand documentary bills are delivered by the collecting bank only against payments. Usually banks accept only documentary bills for purchase as the clean bills do not possess the title to goods and therefore purchasing clean bills are not safe. However purchase of clean bills from good parties also permitted by banks based on sanction terms of the limit. Besides charging normal interest applicable for such advance from the date of purchase till the date of payment of the bill, banks collect normal commission postages and exchange charged on those bills sent for collection.

Usance bills mean the bills maturing on a future date. Such bills are normally delivered to drawee on the basis of documents against acceptance (DA terms). The documents of title to goods of DA bills are delivered to drawee (buyer) by the collecting bank against acceptance of bills by the drawee. The drawer of the bill (seller of the goods) trades such accepted DA bill with his bank for a value less than its face value. The difference between the money paid to the drawer and the face value of the bill is called ‘discount’. The discount amount is calculated by the bank at a percentage of rates per annum from the discount date to the maturity date of the bill on maturity value of the bill. It is important to note that the bank which discounts the documentary usance bills will take into consideration the credit worthiness not only of the borrower but also of the drawee because documentary bills become clean after it is delivered to drawee on acceptance.

Related articles: (Category – Loans and Advances)

- Difference between first charge and second charge

- Difference between Prime and Collateral security

- Meaning of fixed charge, floating charge, and crystallization of charge

- Difference between Overdrafts and Cash Credit facility

- Difference between Open Cash Credit and Key Cash Credit facilities

- Difference between Leasing finance and Hire-Purchase finance

- Difference between loans and advances in bank finances