Export credit facility for service exporters

The Exporters of services may seek finances from banks for their requirements to buy consumables, supplies, and wages. Such exporters shall register with the Electronic and software Export Promotion Council or Services Export Promotion Council or with Federation of Indian Export Organizations, as applicable to their unit to be qualified for working capital export credit…

Read articleSource of funding for Buyers credit and supplier credit

Trade Credit (Buyer’s credit/supplier credit) can be raised by Indian importers in any freely convertible foreign currency (FCY-denominated TC) or Indian Rupee (INR-denominated TC), as per the Trade Credits (TC) framework. Buyers’ credit finance means finance for payment of imports in India arranged by the importer (buyer) from a bank or financial institution outside India.…

Read articleDGFT implements significant improvements in Advance Authorisation and Norms Fixation Workflow

Advance Authorisation Scheme (AAS) or Advance License Scheme is a duty exemption scheme issued by the Government of India (GOI) under the Foreign Trade Policy 2015-2020. The scheme exempts the payment of import duties on raw materials/inputs required for manufacturing products for export. In addition to any inputs, packaging material, fuel, oil, and catalyst which…

Read articleUnderstanding the documents that are mandatory in India for export and import

In the year 2015, the World Bank ranked India at 123 in the ‘Trading across Borders” component of “Ease of Doing Business”, out of 189 countries. In view of facilitating ease of doing business in our country, the Government of India simplified the mandatory documents for exports and imports. The DGFT’s Notification dated 12-3-2015, made…

Read articleWhat is negative statement of export bills?

Where exports made under the Duty Drawback Scheme and such bill remain outstanding beyond the prescribed time limit, the exporter needs to submit a negative statement/certificate to the nodal officer of Department of Excise and Customs on a 6 monthly basis. The negative statement /certificate will be issued either by the authorized dealer (AD) bank(s)…

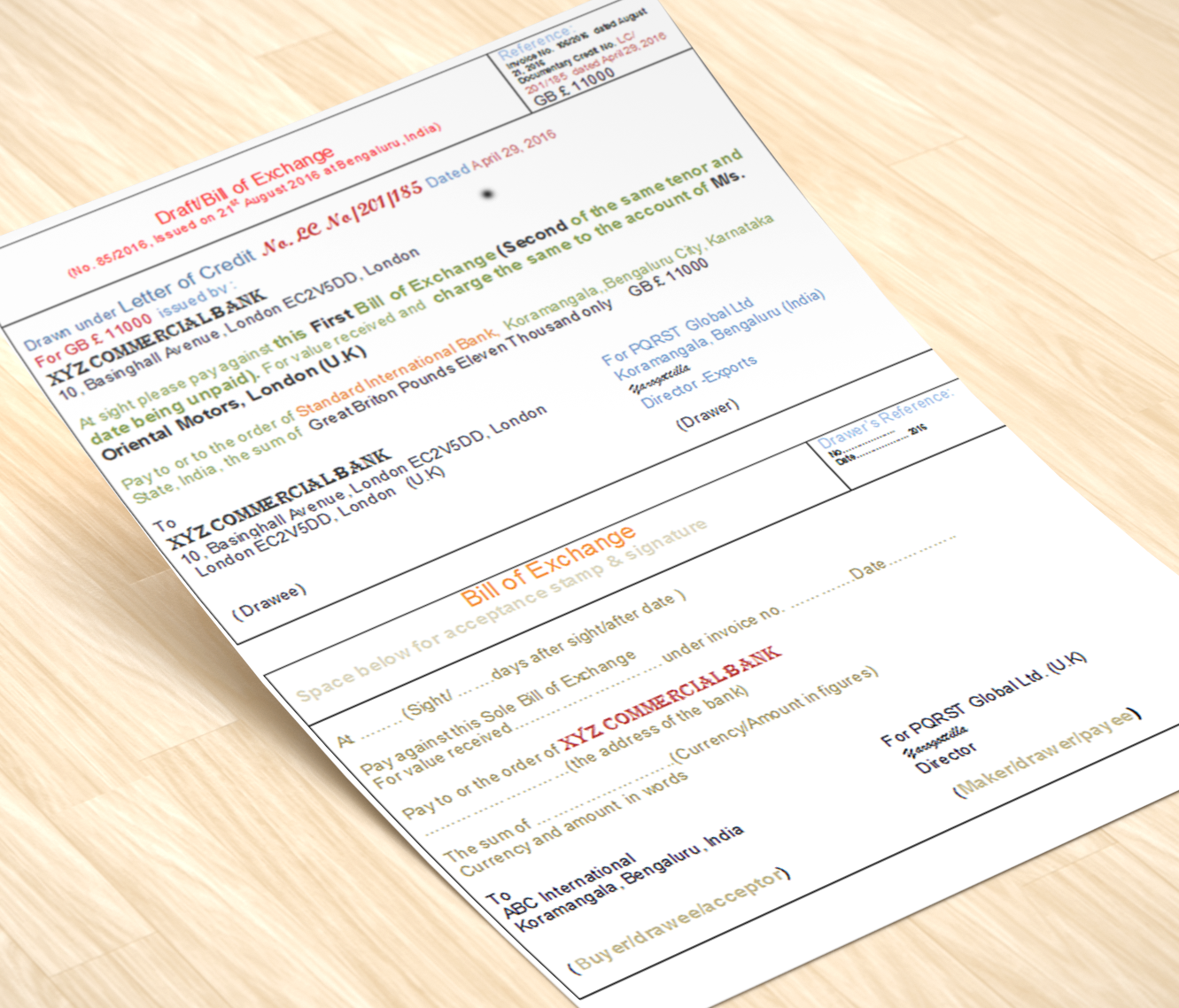

Comparative overview: Purchase, Discount and Negotiation of export bills

The terms ‘bills purchase’,’ bills discount’, and ‘bills negotiation’ are respectively used by the bank for financing against ‘Demand Bills’,’Usance Bills’, and LC bills. The seller of goods (exporter) gets immediate money from the bank for the goods sold by him irrespective of whether it is a purchase, discount, or negotiation by the bank according…

Read article