Who are the parties in a letter of Credit?

(Generally, there are eight parties involved in letter of credit transactions, out of which four principal parties involved in any transaction. This article briefs about four principal parties and other four ordinarily involved in letters of credit transactions). Definition of Letter of Credit: Letter of credit (LC) is an undertaking letter issued by the importer’s…

Read articleExplained: Crystalisation of import bills under LC

The process of converting foreign currency liability of the importer into Indian Rupee liability is called the crystallization of import LC bills. The idea behind the crystallization of import bills is to transfer the probable exchange risk of a non-retired bill amount in foreign currency to the importer. An LC can be issued either against sight…

Read articleOverview: Operations of Letter of Credit – UCP 600 and Important Articles

We all know that in the international trade of goods and services transactions takes place between the people belonging to different continents, languages, culture, and laws. Since the language used for communication of terms and conditions of LC may suggest different meaning in different parts of the world, people across the world realised the need…

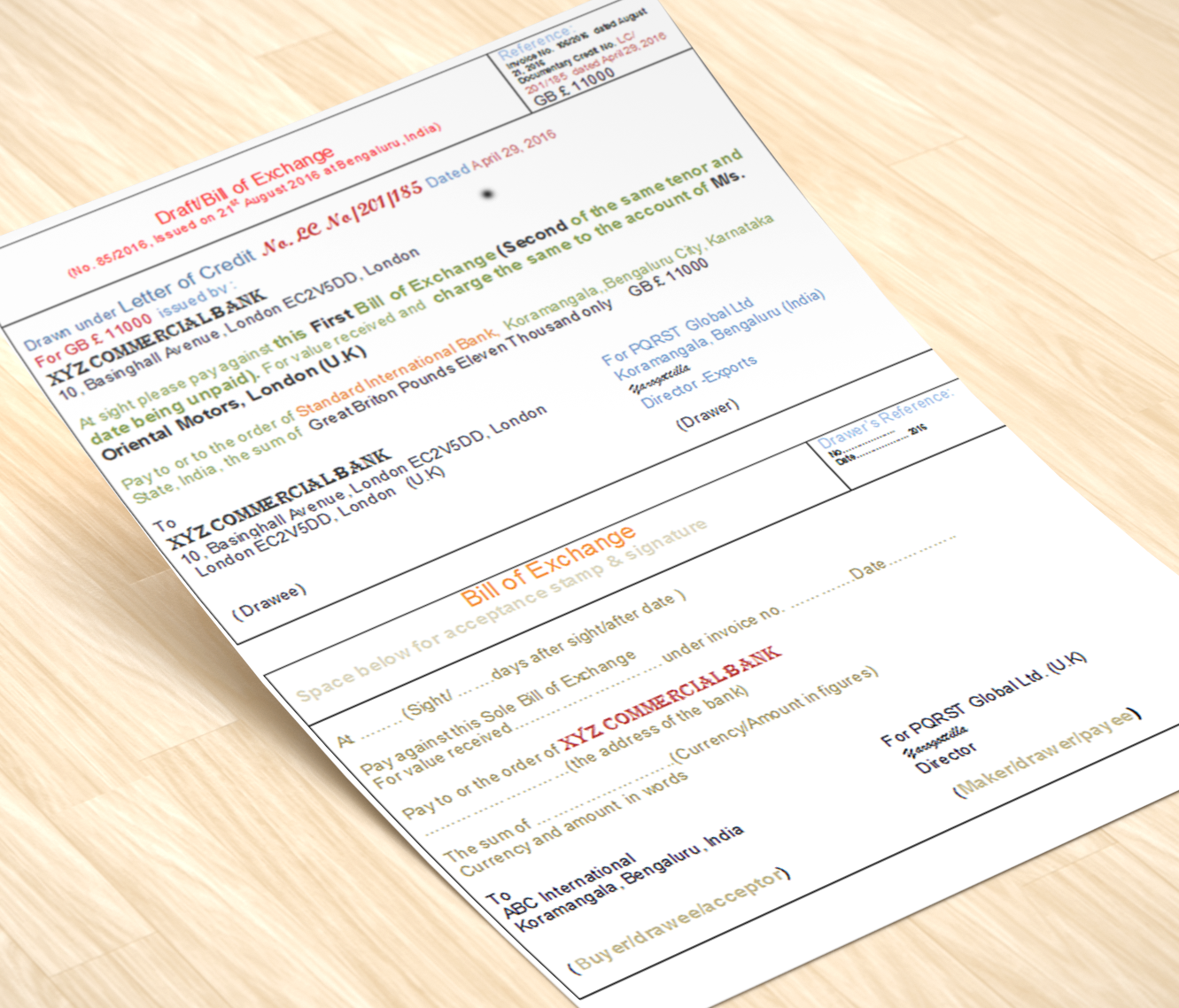

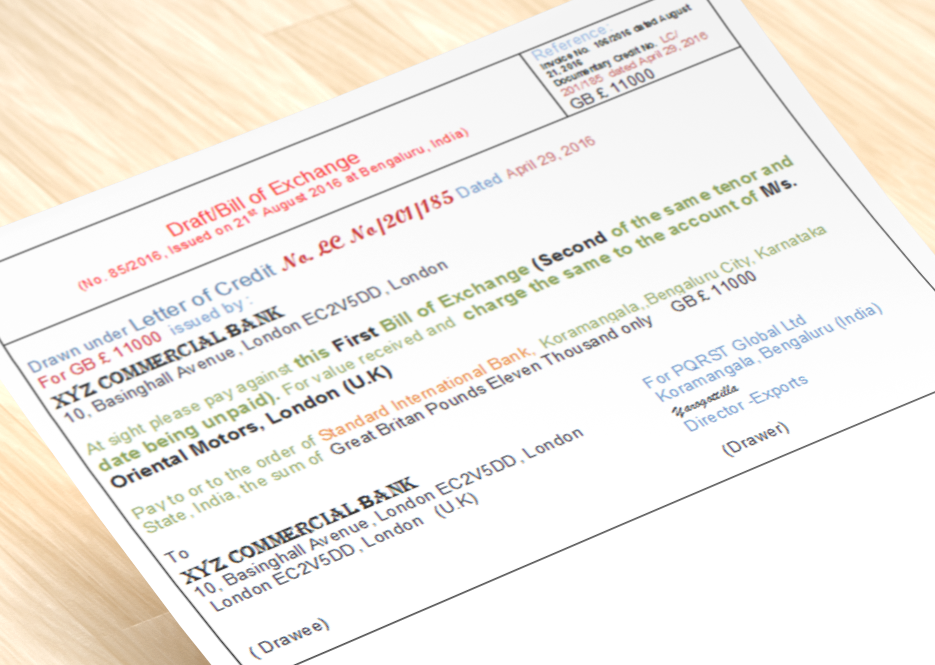

Read articleUnderstanding different terminologies used for the Letter of Credit (LC) transactions

(This post explains about LC on Sight Payment and LC on Usance terms, LC (Inland) and LC (Foreign), Freely negotiable and Restricted Letters of Credit, Uniform Customs and Practice (UCP) for Documentary Credits.) Definition of Letter of Credit: Letter of credit (LC) is an undertaking letter issued by the importer’s (buyer’s) bank wherein the seller…

Read articleWhat is a letter of Credit (LC)?

Letter of credit (LC) also known as Documentary credit is an undertaking from a bank on behalf of its customer (importer/buyer) wherein the beneficiary (exporter) is fully assured of payment provided he fulfills his part of the sale contract embodied in Letter of Credit. To understand LC mechanism, let us take an example of a…

Explained: Crystalisation of overdue export bills

In simple words, the process of converting foreign currency liability of the exporter into Indian Rupee liability is called ‘crystallization of foreign currency export bills’. The purpose of crystallization is to transfer the exchange risk involved in a belated receipt of export bill payment to the exporter. The export bills negotiated/purchased/discounted by a bank are…

Read article