What is a consortium lending?

In consortium lending system, two or more lenders join together to finance a single borrower. The lending banks formally join together, by way of an inter-se agreement to meet the credit needs of a borrower. Here, the sanction of limits to a borrower is completed with common appraisal, common documentation and monitoring the advance with…

Read articleAppraisal of financing infrastructure projects

Any credit facility provided to a borrower company engaged in an infrastructure facility is known as ‘infrastructure lending’. The activities such as developing, or operating, and maintaining, or developing, operating, and maintaining any infrastructure facility of the following sector are called infrastructure projects. Public sector units registered under the Companies Act may be provided infrastructure…

Read articleWhat is a Deferred Payment Guarantee (DPG)?

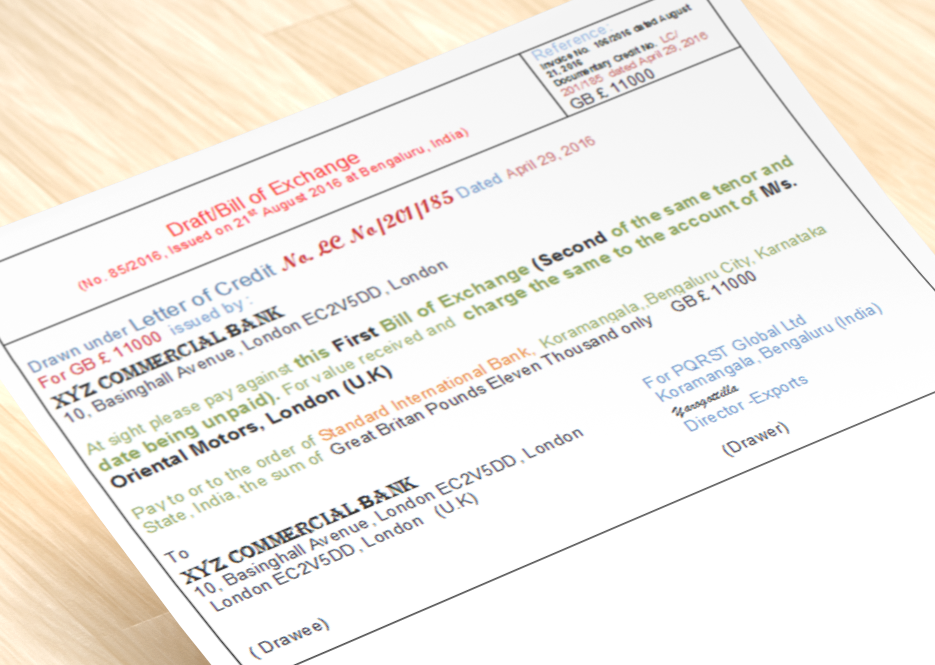

Deferred Payment Guarantee is a guarantee for a payment usually on installments which has been deferred or postponed. Banks issue DPG in the cases of purchase of capital goods/machinery where the seller offers credit to the buyer and buyer’s bank guarantees the due payments to the seller. Here the seller draws drafts of different maturities…

Read articleChallenges in Managing Working Capital Finance

Working capital finance is vital for sustaining daily operations and ensuring a business’s financial stability. However, several operational and strategic issues can hinder its effective management. These include cash flow mismatches, suboptimal inventory control, inefficiencies in receivables and payables, and complications arising from external financing. Missteps in these areas can lead to liquidity constraints and…

Read articleRBI Guidelines on Discounting and Rediscounting of Bills by Banks

The Reserve Bank of India (RBI) has formulated a comprehensive framework to facilitate liquidity through the discounting and rediscounting of genuine trade bills. One of the key mechanisms introduced under this framework is the Bills Rediscounting Scheme (BRDS). This scheme enables banks to raise funds by issuing Usance Promissory Notes (UPNs) based on trade bills…

Framework for project financing and provisioning in infrastructure and real estate sectors

The Reserve Bank of India issued draft guidelines to provide a harmonised prudential framework for financing projects in Infrastructure, Non-Infrastructure, and Commercial Real Estate sectors by regulated entities (REs). In the backdrop of a review of the extant instructions and analysis of the risks inherent in such financing, the Central Bank prescribed norms for restructuring…

Read article