Short-Term Loans from Financial Institutions

Introduction: Term loan is a type of loan where a fixed amount of money is borrowed from a financial institution for a specified period. These loans can be classified as short-term, medium-term, or long-term, with repayment periods typically ranging from one to twenty years. The repayment amount includes both the principal and interest, which may…

Read articleUnderstanding Documentation Procedure and stamping in Banks

It is inevitable for banks to ascertain that bank could easily take possession of such security based on documents obtained from the borrower with very little expenses and dispose-off the same to recover its dues when the account goes bad. Banks obtain ‘Different Types of Documents‘ from the borrower based on the type of security…

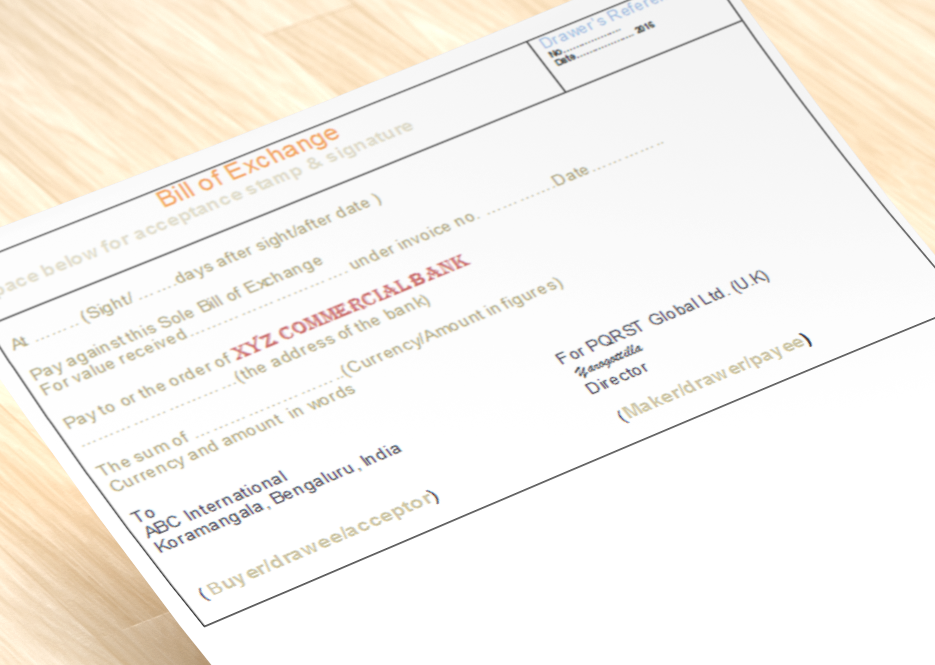

Read articleBills/Receivables Financing by Banks: Mechanisms and Benefits

Receivables financing, also referred to as bills finance, is a facility offered by banks and financial institutions that enables businesses to convert their outstanding invoices (accounts receivable) into immediate liquidity. This form of short-term funding supports effective working capital management by bridging the gap between the delivery of goods or services and the receipt of…

Read articleUnderstanding different types of legally enforceable documents

A legal document is a written agreement between two or more parties that can be relied upon in court. They can be used to establish contractual relationships, grant rights, or provide evidence for legal obligations. It is inevitable for banks to ascertain that they could easily take possession of such security based on documents obtained…

Read articleThe complete mechanism of ‘TReDS’ that helps MSME finance

TReDS (Trade Receivables Discounting System) is an institutional setup for the flow of finance to micro, small, and medium enterprises (MSMEs) through multiple financiers at a competitive rate. The model outlined for TReDS in the paper, envisages its operation both in the primary market segment as well as a secondary market segment as authorised payment…

Non-fund based Limits: Understanding the different types of Guarantees/Bonds issued by Banks

The credit facilities given by the banks where actual bank funds are not involved are termed as ‘non-fund based facilities’. Various types of guarantees are issued by the banks on behalf of their customers. Bank Guarantees (BG) is also known as Letter of Guarantees which can be broadly classified as (i) Financial Guarantees and (ii)…

Read article