Regulatory Guidelines on Credit Risk Management and Credit Information Systems

IntroductionThe Reserve Bank of India (RBI) has issued comprehensive guidelines on credit risk management with a specific emphasis on the development and utilization of Credit Information Systems. These guidelines are intended to strengthen the credit appraisal and monitoring mechanisms of financial institutions, reduce the incidence of Non-Performing Assets (NPAs), and promote a prudent and resilient…

Read articleUnderstanding Credit Risk: Key Factors and Mitigation Strategies

IntroductionCredit risk, also referred to as default risk, represents the potential for financial loss resulting from a borrower’s failure to repay a loan or meet contractual debt obligations. It is a critical concern for financial institutions, investors, and other lenders, who must evaluate and manage this risk to protect their capital and ensure financial stability.…

Read articleIntegrated Approach to Credit Risk Management and Credit Rating

IntroductionCredit risk management and credit rating are interrelated components of a sound lending framework, enabling financial institutions to evaluate and mitigate the risk of borrower default. While credit risk management encompasses internal strategies and procedures aimed at minimizing losses from defaults, credit ratings—typically assigned by external agencies—provide an independent evaluation of a borrower’s creditworthiness. Together,…

Read articleFramework for project financing and provisioning in infrastructure and real estate sectors

The Reserve Bank of India issued draft guidelines to provide a harmonised prudential framework for financing projects in Infrastructure, Non-Infrastructure, and Commercial Real Estate sectors by regulated entities (REs). In the backdrop of a review of the extant instructions and analysis of the risks inherent in such financing, the Central Bank prescribed norms for restructuring…

Read articleDFS advises banks to invoke personal guarantees and initiate IBC proceedings against the guarantors whenever possible

According to the sources with direct knowledge of the matter, the Department of Financial Services (DFS) has written a letter to Chairmen and heads of the banks on August 26, asking them to consider setting up of an IT system to collate such data, The IBC code amendment 2019 allows creditor to permits file insolvency…

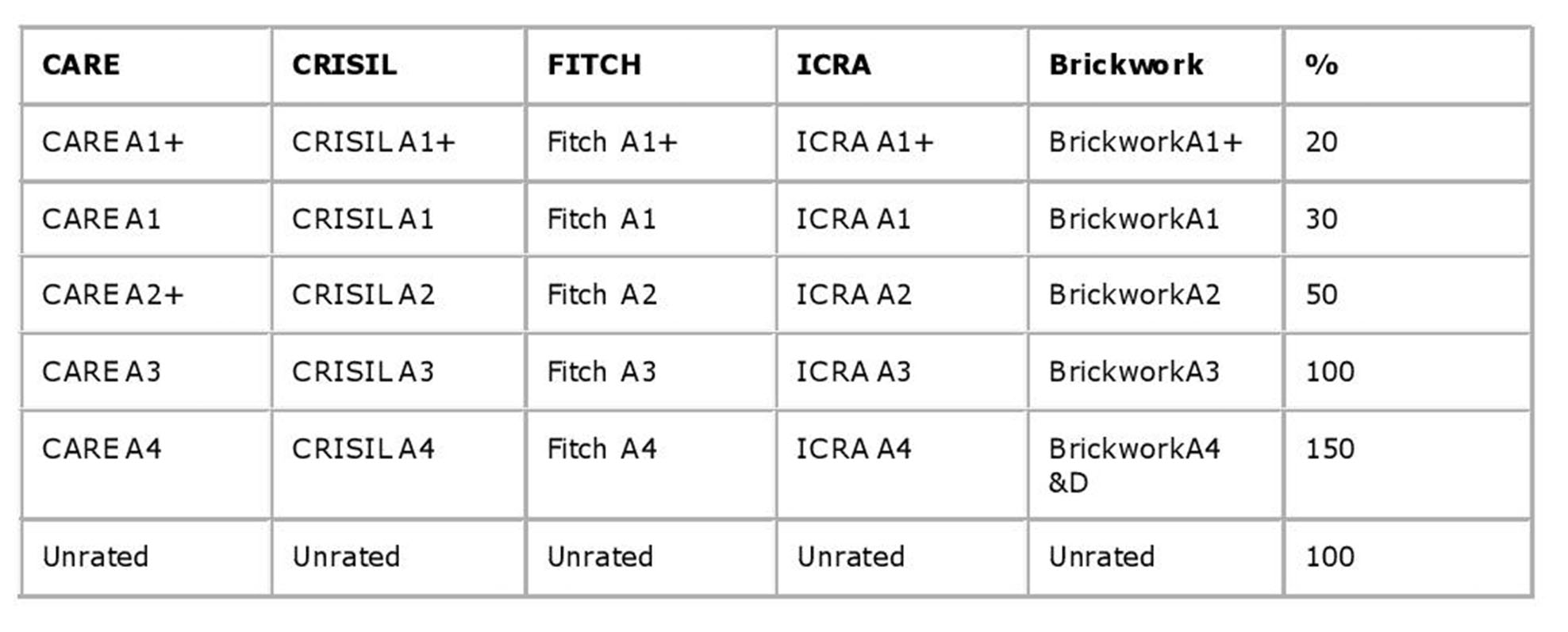

Understanding credit score and credit information companies in India

Both the terms credit ratings and credit scores assess creditworthiness and risk involved in lending to an entity. A credit rating agency provides an opinion relating to future debt repayments by borrowers. The rating is assigned to a security or an instrument that even assigns an issuer rating. A credit bureau (Credit information Company) provides…

Read article