What is a contingent liability?

A contingent liability may be defined as a possible obligation that arises from past events and depends on the outcome of an uncertain future event. CONTINGENT LIABILITIES are those liabilities which may arise when certain claims are settled in the near future. So anything that is under litigation or liability is not ascertained as to…

Read articleBank Reconciliation of inter branch/office entries

Reconciliation is a financial process that compares internal financial statements with external sources to identify discrepancies and maintain financial reliability. Reconciliation is a financial process that compares transactions and activity to supporting documentation and resolving any discrepancies that may have been discovered. Inter-office adjustments are differences that may occur due to incomplete recording of transactions…

Read articleExplained: Functions Performed by the Back Office

The back office in an organisation exists to finalise the transactions conducted by the front office. This includes confirming transactions and settlement instructions with the back office of the counterparty. The back office is essential for maintaining the integrity of the financial system and ensuring the accurate processing of customer transactions. The back office is…

Read articleAccounting Systems of Different Banks Illustration

Banks in different countries use different accounting principles and practices due to the legal requirements of their home country. These legal requirements are based on cultural attitudes towards business, and the stage of development of their economies resulting in a diversity of accounting standards and regulations, which affects the preparation and presentation of financial statements.…

Read articlePeculiar and significant features of accounting system in banks

The general structure of the accounting system and financial statements for banks isn’t that much different from a regular business. However, there are significant differences in the sub-classification of accounts. Banks need to deal with various complex issues like Technological disruptions, Cybersecurity threats, Regulatory compliance, Talent management, Geopolitical and economic uncertainties, etc. Therefore, such issues…

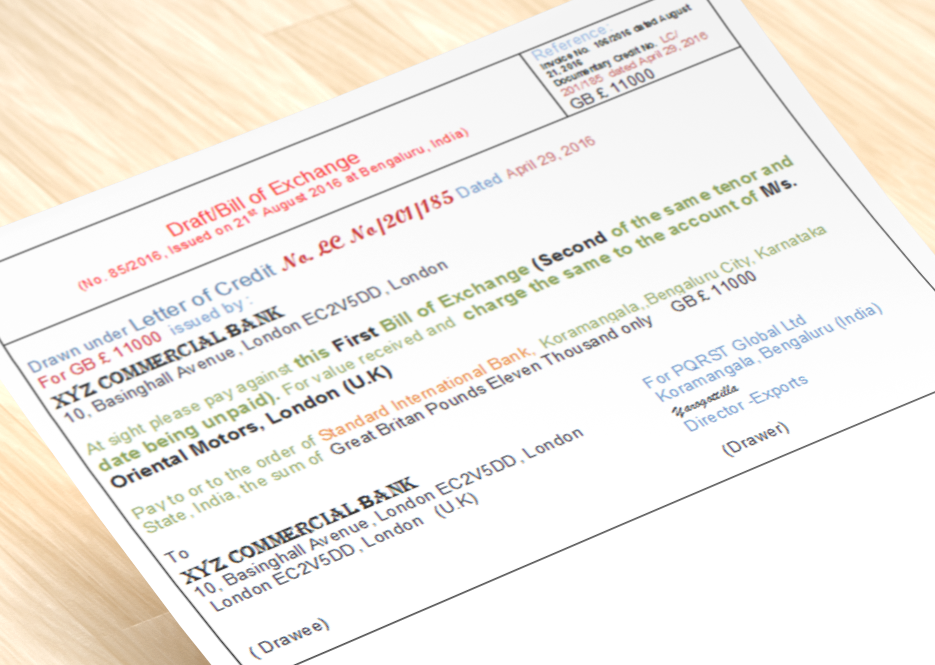

Explained: Accounting Entries to be passed for bills of exchange transactions

Accounting for bills of exchange starts when the drawer draws a bill and the drawee accepts it. The drawer receives back the bill after the drawee accepts the bill and returns it to the drawer. The drawer becomes the holder of the bill accepted by the drawee. Once the drawer is the holder of the…

Read article