Retail banking primarily serves individual consumers and small businesses by offering a range of financial products, including savings accounts, loans, and credit cards. These services are delivered through multiple channels to ensure accessibility and convenience. Retail banking enables customers to manage their finances effectively, access credit facilities, and deposit funds securely. Beyond its core functions of credit and deposits, retail banks also provide supplementary services such as nomination facilities, rental of safe deposit lockers, safe deposit vaults, cross-selling of gold coins, mutual fund products, depository services (Demat accounts), and life and health insurance products.

Key Characteristics of Retail Banking

1. Customer-Centric Business

Retail banking places a strong emphasis on addressing the needs and preferences of individual customers to foster long-term relationships. Customer satisfaction and retention are critical objectives, achieved through personalized financial services, effective customer support, and the resolution of customer concerns. Retail banks frequently offer tailored financial advice and customized solutions to meet the diverse needs of their clientele.

2. Comprehensive Products and Services

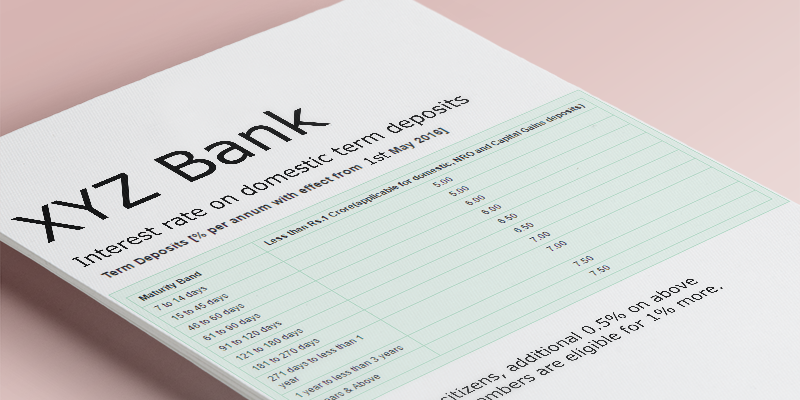

Deposits: Retail banks offer a variety of deposit products, including savings accounts, checking accounts, fixed deposits, and recurring deposits, catering to different financial needs.

Loans: Loans are structured financial products with predetermined repayment terms, interest rates, and tenures. Advances, in contrast, are more flexible financial facilities, typically provided as overdrafts or credit lines that can be adjusted according to the borrower’s immediate needs. Retail banks also engage in the purchase of foreign exchange bills, particularly in the context of export financing, where pre-shipment credit (packing credit) is extended to exporters and subsequently liquidated through bill proceeds. Additionally, beyond direct loans and advances, retail banks issue Letters of Credit (LC) and guarantees on behalf of customers to meet various business obligations within regulatory frameworks.

Payment Services: Retail banks facilitate transactions through debit cards, credit cards, online banking, and mobile banking platforms, ensuring efficient and secure payment processing.

Other Services: Additional services offered include safe deposit boxes, currency exchange, and investment products to enhance customers’ financial security and wealth management.

3. Diverse Distribution Channels

- Branch Network: Retail banks operate physical branches to provide in-person customer service and transactional support.

- Online Banking: Digital banking platforms enable customers to access accounts, conduct transactions, and manage finances remotely.

- Mobile Banking: Dedicated mobile applications allow users to perform banking activities conveniently from their smartphones.

- Automated Teller Machines (ATMs): ATMs provide customers with cash withdrawal, balance inquiry, and other essential banking services.

4. Robust Risk Management

- Credit Risk Management: Retail banks evaluate and mitigate credit risks associated with loans and credit products to maintain financial stability.

- Fraud Prevention: Stringent security measures are implemented to detect and prevent fraudulent transactions.

- Regulatory Compliance: Retail banks adhere to financial regulations and industry guidelines to ensure operational integrity and legal compliance.

5. Target Customer Segments

- Individuals: Retail banks cater to the financial requirements of salary earners, students, retirees, and other individual consumers.

- Small Businesses: Financial solutions are tailored to support the operational and growth needs of small enterprises.

- Community Banks: Certain retail banks focus on specific communities or demographic groups to provide localized banking services.

Retail banking plays a crucial role in the financial ecosystem by offering accessible and customer-oriented financial solutions while ensuring compliance with regulatory standards and risk management principles.

Related Posts: