In a Letter of Credit (LC) transaction, documentary scrutiny is a vital process undertaken by banks to ensure that the documents presented by the beneficiary (exporter) strictly comply with the terms and conditions outlined in the LC. This examination involves assessing the authenticity, accuracy, completeness, and internal consistency of the submitted documents, in alignment with the LC terms and with one another.

Key Aspects of Documentary Scrutiny under an LC

1. Initial Scrutiny

- Document Compliance:

Banks verify that all documents stipulated in the LC have been submitted in the correct number of copies and as per the prescribed format. - Issuing Authority:

Each document must be issued and signed by the entities specified in the LC (e.g., shipping companies, chambers of commerce, insurers). - Date Consistency:

Dates on documents must comply with LC requirements and be logically consistent across all documents (e.g., shipment date on the bill of lading should not precede the invoice date). - Authentication of Alterations:

Any handwritten changes or additions on documents must be duly authenticated by the issuing authority. - Originals and Copies:

Documents must be marked as originals or clearly identified as such, and appear properly signed and authorized.

2. Scrutiny of Individual Documents

Each document submitted under an LC is examined individually for compliance:

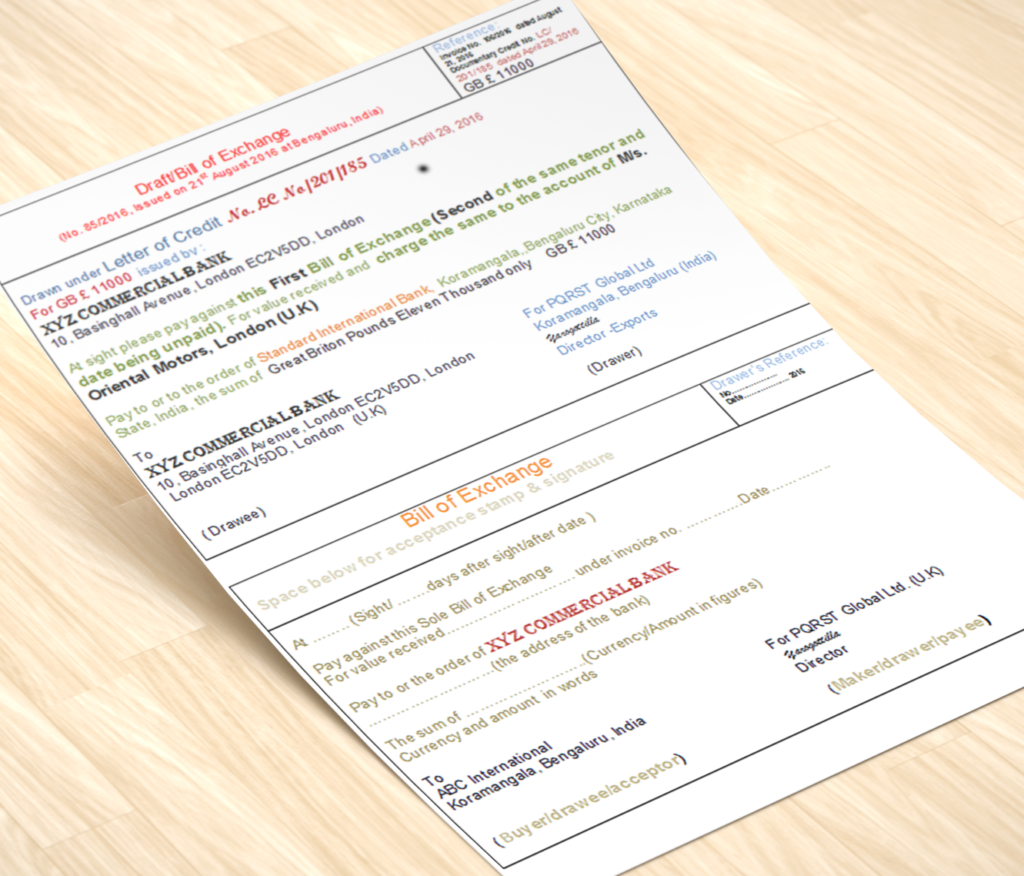

- Commercial Invoice:

Validates the value, description, and terms of the goods or services; must match the LC specifications and be issued by the beneficiary. - Bill of Lading / Airway Bill:

Serves as proof of shipment and details the mode and terms of transportation. Must be clean, dated, and correctly consigned. - Insurance Certificate:

Demonstrates that insurance coverage is in place, as required by the LC, and is valid for the full value of the goods. - Certificate of Origin:

Certifies the country of origin of the goods, often required for customs and tariff purposes. - Other Supporting Documents:

Includes packing lists, inspection certificates, weight certificates, and any other documents specified in the LC.

3. Common Discrepancies Identified

Banks are alert to frequently encountered discrepancies, which may lead to refusal of documents:

- Incorrect Dates:

Disparities between dates across documents or non-compliance with LC-mandated timelines. - Quantity Mismatches:

Inconsistencies in quantities of goods among the invoice, packing list, and bill of lading. - Missing Signatures or Stamps:

Omission of required authorizations, stamps, or signatories. - Descriptive Inconsistencies:

Variations in the description, value, or weight of goods between documents. - Document Expiry:

Presentation of expired LCs or supporting documents beyond their validity period.

4. Significance of Documentary Scrutiny

- Payment Authorization:

Only upon satisfactory document scrutiny can the bank authorize payment to the beneficiary. - Risk Mitigation:

Identifying discrepancies early helps banks prevent financial exposure and disputes. - Regulatory Compliance:

Ensures adherence to the terms of the LC, international standards (e.g., UCP 600), and applicable trade and banking regulations.

Conclusion

Document scrutiny is a cornerstone of the LC process, ensuring that payment is made only when documentary compliance is achieved. This meticulous review protects the interests of all parties—especially the issuing and confirming banks—and upholds the integrity of international trade transactions. Understanding the documentary requirements and common pitfalls helps exporters and importers navigate the LC process more effectively.

Related Posts: