Credit rating agencies provide an objective and unbiased evaluation of the credit risk of diverse entities, including individuals, groups, businesses, non-profit organisations, governments, and even nations. They provide transparency and consistency in assessing institutions/borrowers’ creditworthiness, making it easier for lenders and investors to make informed decisions.

The main characteristics of credit rating are that these agencies compile comprehensive reports encompassing various factors to establish a credit rating including the borrower’s borrowing and lending history, capacity to honour debt obligations, previous indebtedness, future economic potential, and more.

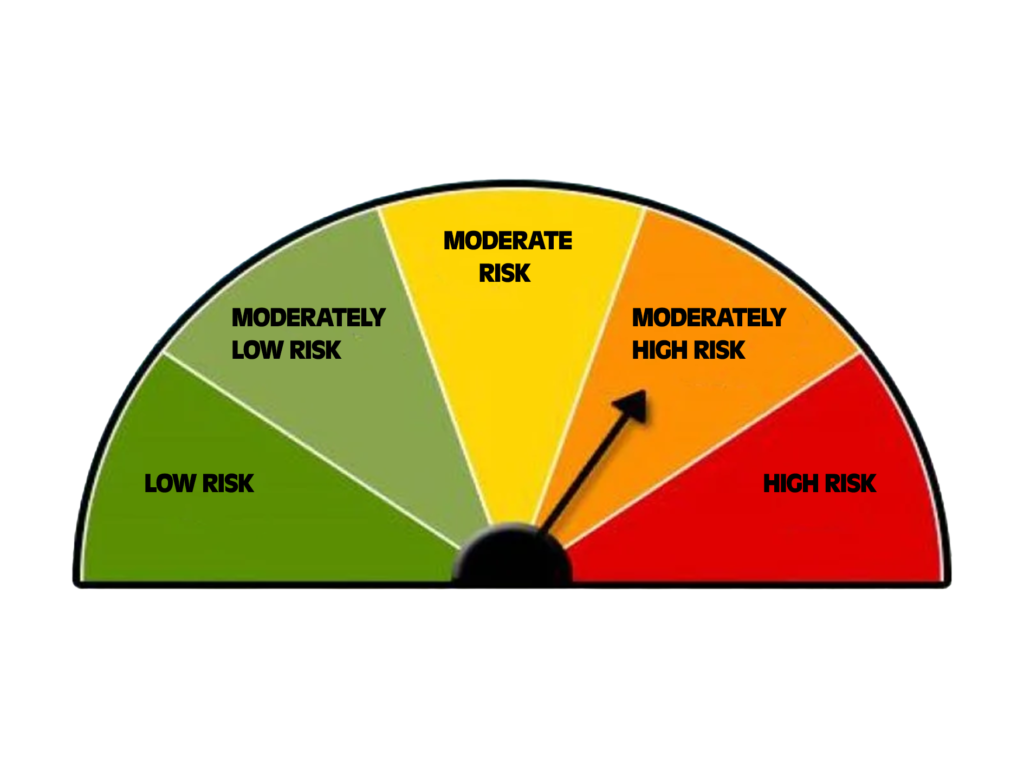

Credit rating agencies employ unique terminologies within their credit rating scales to delineate the risk inherent to corporate entities. These credit rating systems are designed for this purpose.

Please see the following image of different credit rating agencies indicating their credit rating uniquely.

+++

A credit ratings agency assesses the issuer’s capacity to meet financial obligations. It assesses the borrower’s financial strength. Credit ratings classified as investment grade signify that the corporate entity has demonstrated prudent investment practices and can repay debts promptly. Ratings expressed in symbols e.g. AAA, BBB, etc., which can be understood by laymen easily. Credit Rating is done by experts of, reputed, accredited institutions. Credit Rating is only guidance to investors that provides recommendations to the investors on whether to invest in any particular investment. Credit ratings falling within the speculative-grade category indicate that a corporate borrower has engaged in high-risk investment activities and may face challenges in repaying the loan. Entities receiving ratings in this category are typically granted loans at higher interest rates, reflecting the increased risk involved.

Importance of Credit Ratings:

Credit rate agencies investigate the financial position of the company issuing various kinds of instruments and assess the risk involving investing money in them. Credit ratings are useful for borrowing companies, lenders as well as investors. For borrowing companies, credit ratings determine their eligibility for obtaining loans to support operational or expansionary endeavours. Lenders rely on credit ratings to evaluate a company’s creditworthiness and make informed decisions regarding loan approvals or denials. Individual and institutional investors analyse credit rating terms to assess the risks before investing in a company’s shares or bonds.

Benefits of Credit rating

Investor Confidence: High credit ratings provided by a reputed credit rating agency attract investors, leading to better access to capital and potentially lower costs.

Informed Decision Making: Credit Rating Agencies provide default risk assessments, allowing lenders to judge the likelihood of borrowers repaying their debts if any. This information is paramount for approving loans, setting interest rates, and managing overall risk exposure.

Efficient Capital Allocation: By categorizing borrowers based on their creditworthiness, Credit Rating Agencies help the efficient allocation of capital in the market. Investors can choose investments based on their risk tolerance, and borrowers with better credit ratings typically have access to cheaper capital.

Market Transparency: The rating agencies make sure & ensure transparency in the market by providing independent and objective opinions on borrowers’ financial health. This helps prevent information asymmetry and promotes fair competition.

Benchmarking and Regulation: Credit ratings serve as benchmarks for financial regulators and policymakers to assess risks within the system and implement appropriate regulations.

Related Posts: