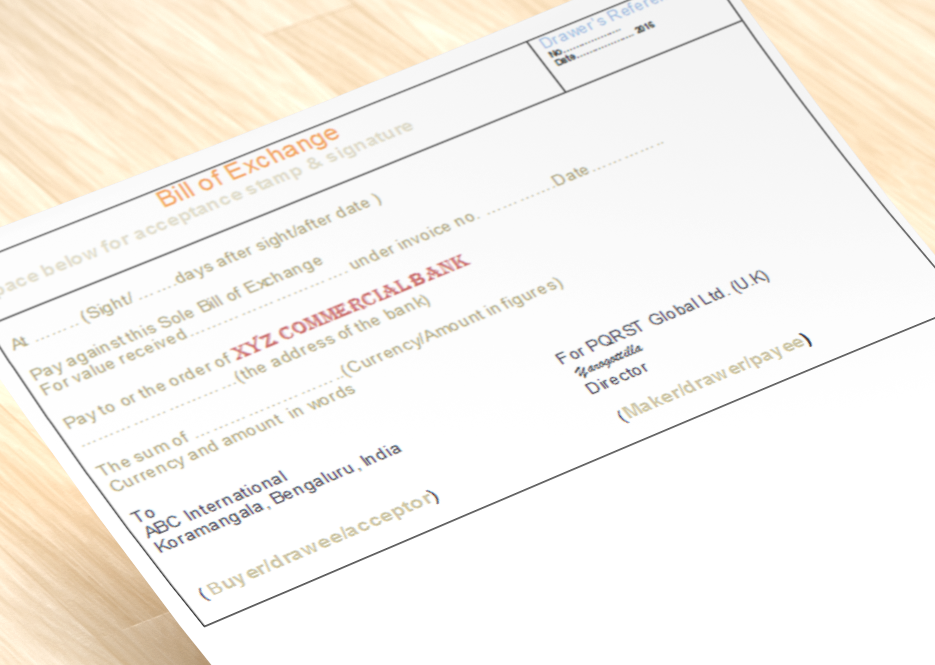

A creditor is a person who has sold goods on a credit basis and a debtor is a person who has purchased goods on a credit basis. Thus, a bill that is drawn by a creditor and accepted by a debtor is known as a trade bill of exchange. An accommodation bill is a bill, draft, or note that is created, accepted, endorsed, or drawn by one person for another without being backed by any trade transactions.

Following are the differences between the trade and accommodation bills:

| Trade bills | Accommodation Bills |

| Trade bills are a form of credit | Accommodation bills are not loans or credits |

| Drawn not for trade purposes | Drawn not for trade purpose |

| Trade bills are based on sales and purchases of goods | Accommodation bills are drawn to help someone in need of funds. |

| Trade bills are drawn by creditors and accepted by debtors | Accommodation bills are not drawn by creditors |

| Trade bills are drawn against proper consideration | Accommodation bills are drawn without any consideration. |

| Drawn for trade purposes | Trade bill is proof of debts |

| Before the bill’s maturity date, the seller can discount the bill in the bank. | Before the bill’s maturity date, the accommodation party (drawer of the bills) can discount the bill in the bank. |

| An accommodation bill is not proof of debts | Accommodation bills are similar to trade bills but not enforceable by law since they lack consideration, and they run on the moral understanding of the parties that draw the bill |

| For obtaining the debt from the drawee, the drawer can resort to legal action | For obtaining the debt from the drawee, the drawer cannot resort to legal action |

| Trade bills are the most commonly used type of bill of exchange, | Accommodation bills are less common. |

The bookkeeping entries in connection with accommodation bills are made in the same way as for genuine bills.

Related posts