A buyer of goods requires original shipping documents to take delivery of goods shipped to him by the seller. The seller (exporter) after shipment of goods prepares necessary set of documents related to goods like Bill of lading/Airway bills, LR, RR, dock warrant, dock receipt, warehouse receipt, etc. along with the invoice of the goods dispatched and order for the delivery of title to goods. The delivery of title to goods to the buyer (importer) can be either against payment (DP bills) or against the acceptance of bills (DA bills).

In the case of Delivery against Payment (DP) bills, the drawee collects the ‘documents of title to goods’ from the bank after making the payment of invoice value to the bank and takes the delivery of goods consigned to him from the carrier.

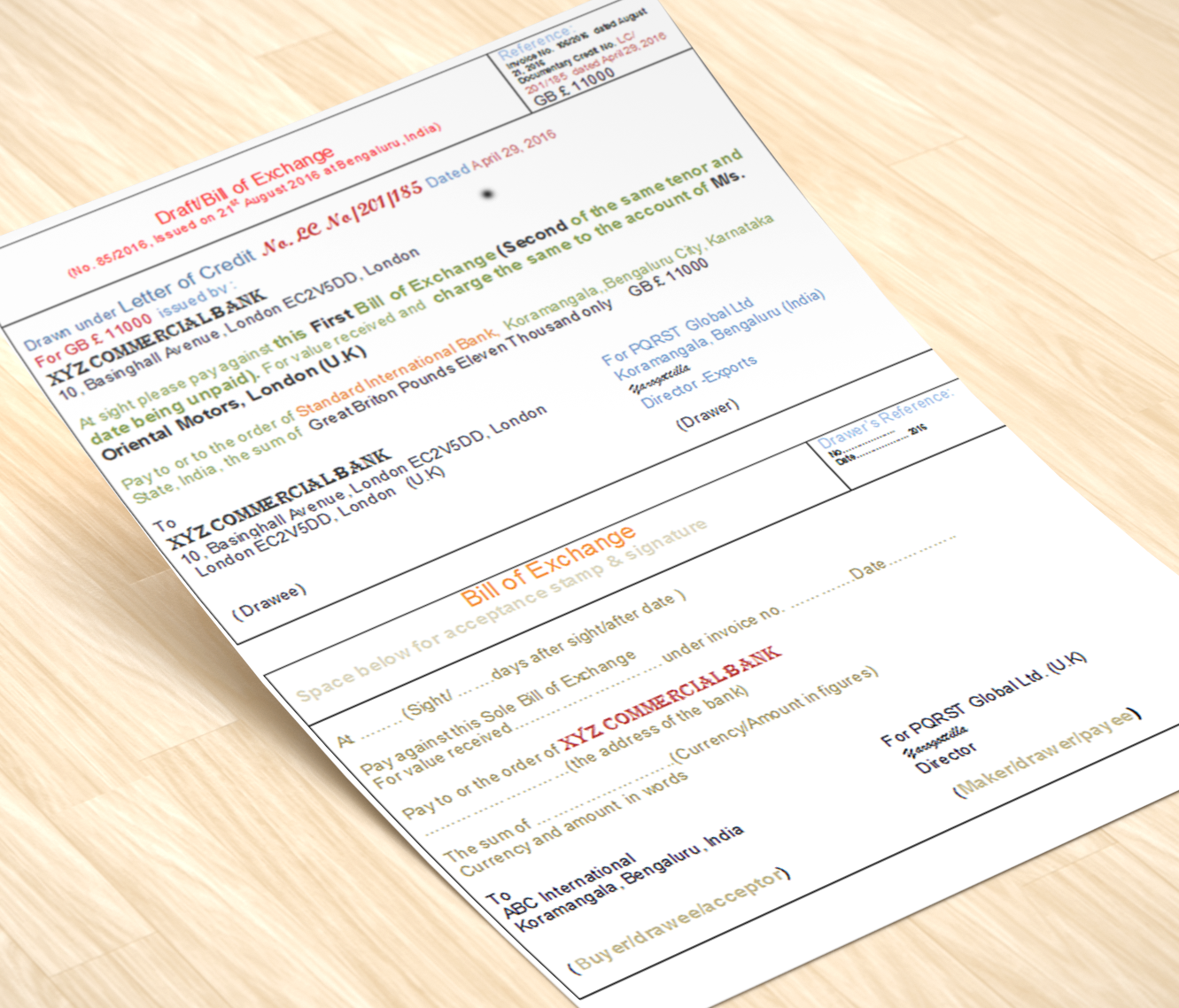

In the case of Documents against the Acceptance (DA) bills, the exporter’s (seller’s) bank instructs the buyer’s bank to deliver the title documents to drawee (buyer) against the acceptance of bills of exchange. Buyer’s bank notifies to the buyer for ‘acceptance of bills’ (acceptance of bills of change) and allows the buyer to take the delivery of the documents of title to goods against acceptance bill.

Acceptance of bills means that the drawee of the bill (buyer) unconditionally accepts the drawer’s (seller’s) bill of exchange without altering the original terms of the bill. By signing under the word “accepted” on the face of the bill the drawee commits an unconditional obligation to pay it to the seller on or before the maturity date of the bill. Unless the bill is accepted by the drawee, the drawee of the bill is not liable on any bill addressed to him for payment.

Typically, the drawee puts his signature below the word “accepted” which means that he has agreed to pay the amount as ordered by the drawer (seller). Yet, a simple signature of the drawee either on the face or back of the bill of exchange instrument is also deemed as acceptance of bill. The drawee takes the delivery of goods consigned to him from the transporter, once the documents of title to goods released to him.While discounting the DA bills, banks are seeing the credit- worthiness not only of the borrower but also of the buyer (drawee); because the bill becomes clean after documents of title to goods delivered to drawee on acceptance of the bill.

Click below for related articles:

Finance, economics, and accounting are deeply interconnected disciplines that influence one another. A thorough understanding…

Introduction The organization of the finance function involves structuring financial roles, responsibilities, processes, and systems…

Business ethics involves managing values and resolving conflicts. It refers to the moral principles, policies,…

An agency problem in financial management refers to a conflict of interest between a company’s…

The risk-return trade-off is an essential investment principle that states that higher risk often comes…

The concept of Financial Building Blocks (FBB) serves as a powerful tool for understanding the…