The word ‘bills’ is the acronym to ‘bills of exchange’. There are different kinds of bills of exchange viz. Clean Bills, Documentary bill, Demand bills, Usance Bills, Accommodation Bills etc.

Clean Bill:

When the document of title to goods (like LR/RR/BL/Airway bill etc.) is not accompanied by a bill of exchange, it is called as a clean bill. Clean bills indicate that the goods are directly delivered to the buyer /drawee. The Clean bill may be payable on demand or at a definite future date.

Documentary Bills:

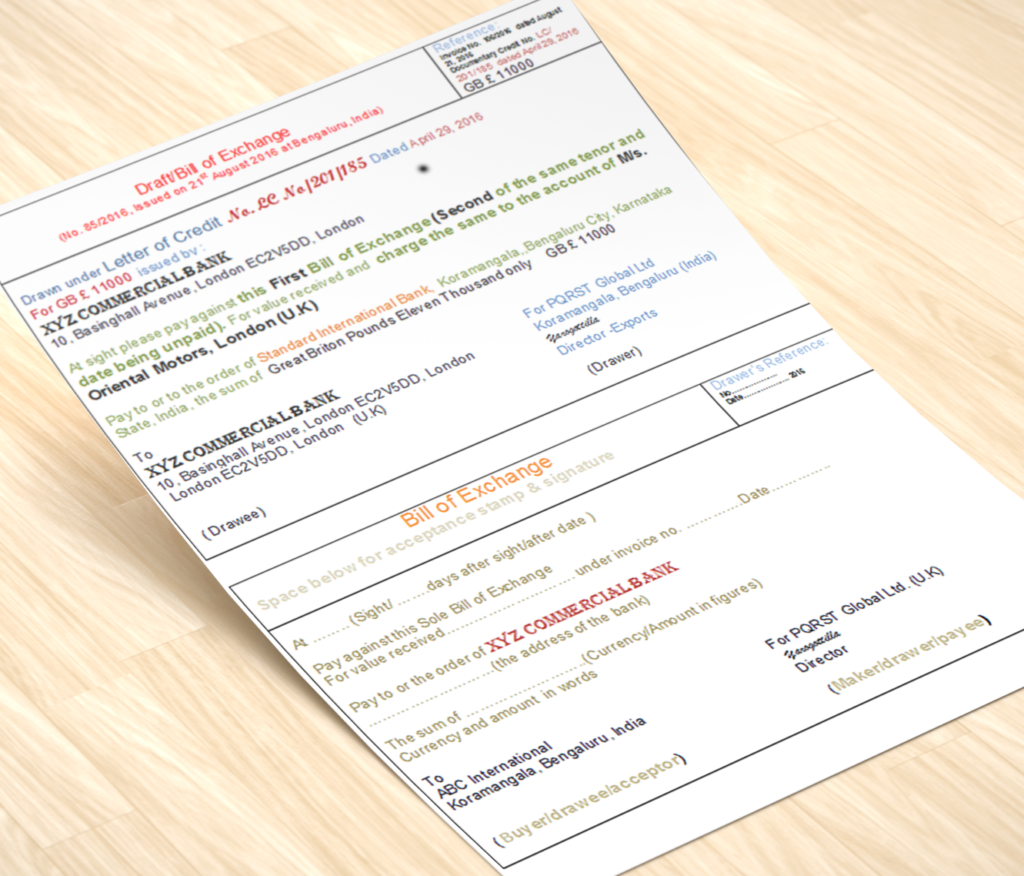

When the bill of exchange is accompanied by the bill of lading/Airway bills, L/R, dock warrant, dock receipt, warehouse receipt, etc. evidencing dispatch of goods to the buyer along with the order for the delivery of goods (document of title to goods), is called documentary bills. The documentary bill may be payable on demand or at a definite future date.

Demand Bills:

A bill which is articulated to be payable on demand is called demand bill. The bills which is drawn payable at sight or on presentation or in which no time is specified for payment are reckoned as demand bills.

Usance Bills:

The Usance bill is one which is expressed to be payable at a specified future date are called Usance Bills. These bills bear the terms like ‘after date’ or after sight. ‘After date’ suggests that the due date for payment of the bill will be calculated from the date of the bill. ‘After sight’ means that the due date for payment of the bill will be calculated from the date of presentment to the drawee for acceptance of the bill.

As per Section 22 of NI Act, a bill expressed to be payable at a future date is at maturity on the third day after the due date. Thus, three days so allowed for payment of the bill is called ‘days of grace’ after the day on which it is expressed to be payable and the bill shall mature for payment on the last day of grace. However, if a Usance bill instrument clearly disallows the grace period, mentioning in the instrument ‘Without grace’, ‘No grace’ or ‘fixed’, in such cases bills shall be payable on the specified date without grace.

Accommodation Bills:

The bill which arises due to genuine trade transactions such bill is called genuine bills or bonafide bills. However, when somebody lending his name and signs a bill as drawer (seller), or acceptor (drawee/buyer) or endorser without receiving the value thereof, such bills are called accommodation bill. The house bills/accommodation bills are usually drawn by group concerns on one another for the purpose of borrowing from banks without actual transactions.

Cheque:

A cheque is also a kind of bill of exchange with certain peculiarities. The difference between a cheque and other bills of exchange is that the cheque is always drawn on banker and same is payable on demand whereas other bills of exchange can be made payable after the fixed period.

Click below for related articles:

- Checklist for banks financing LC/ co-accepted bills

- Meaning of inland bills and foreign bills

- Meaning of DP bills, DA bills, and Acceptance of Bills,

- What is co-acceptance of bills?

- Crystallization of overdue export bills

- Crystallization of Import LC bills

- Post shipment finance to exporters without packing credit facility

- How to liquidate packing credit loan without post-shipment finance?

- Meaning of Normal transit period and notional due date