RBI Issues 5th Amendment to SNRR Account in the FEMA (Deposit) Regulation 2025

A Special Non-Resident Rupee (SNRR) Account is opened with Authorized Dealer (AD) banks in India for specified transactions related to trade, foreign investments, External Commercial Borrowings (ECBs), and more. It serves as an alternative to executing inward/outward remittances in convertible foreign currency for each transaction with residents in India. This account allows non-residents with business…

Read articleComparative overview of FCNR (B) and NRE Deposits

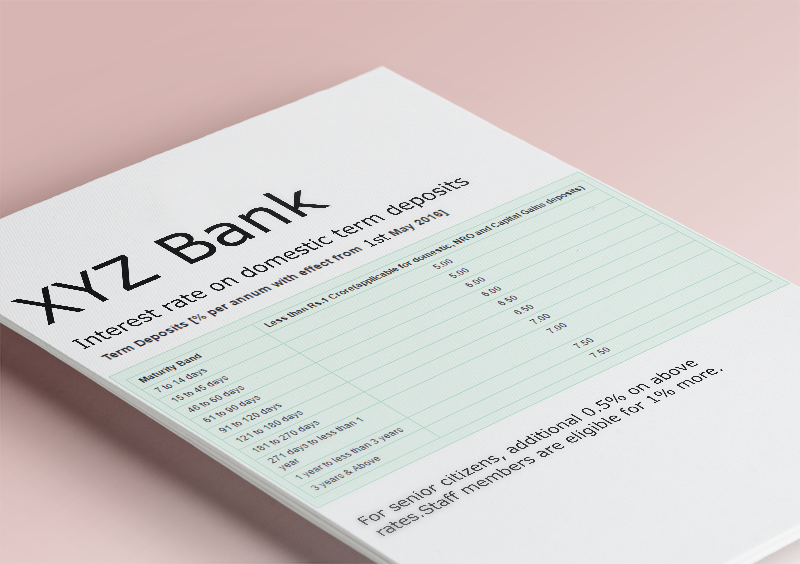

FCNR (B) deposits and NRE deposits can be opened by Non-Resident Indians or persons of Indian Origin (PIO) or Overseas Citizens of India (OCI). The difference between FCNR (B) deposits and NRE deposits is that the FCNR-B (Bank) deposits are maintained only in Foreign Currencies term deposits and maturity of these deposits is payable in terms…

Read articleMeaning of Non-Resident Indian(NRI) and Banking Facilities available to them in India

A non-residential Indian is a person who stays outside India for 182 days or more An Indian citizen or a foreign citizen of Indian origin who has stayed abroad for employment/carrying out business or vocation for 182 days or more during the period of the foreseeing financial year. Non-Resident Indians (NRIs) are permitted to open…

Read articleUnderstanding Diamond Dollar Accounts (DDAs) in the Indian Banking System

Diamond Dollar Accounts (DDAs) are specialized current accounts denominated in US dollars, maintained with banks in India. These accounts are exclusively available to firms and companies engaged in the import and export of rough or cut and polished diamonds, coloured gemstones, and precious metal jewellery, whether plain, enameled (minakari), or studded with diamonds or other…

Read articleA comprehensive overview of bank Deposits: Various account types, their features

[This post answers questions about the rules related to addition or deletion of names in FD, TDS in case of joint accounts, interest calculation in leap year, conditions for deposits held in minor’s name, transfer of fixed deposits, interest payment on prematurely closed deposits, renewal of Overdue deposits, and deposits in the joint names of…

What is a 2-in-1 Account?

A 2-in-1 account refers to a financial product that integrates a Demat (Dematerialized) account with a trading account, thereby streamlining the process of buying and selling securities. This consolidated arrangement allows investors to deposit funds, manage securities, and execute trades through a single platform, enhancing convenience and operational efficiency. In banking terminology, the term “2-in-1…

Read article