In the dynamic world of banking, risk management forms the foundation of stability, trust, and long-term value creation. Banks operate in an inherently risky environment, exposed to credit risks, market fluctuations, operational challenges, cyber threats, and compliance obligations. A well-defined organisational structure, supported by a clear risk management policy, consistent appetite setting, and robust identification processes, ensures that institutions remain resilient amid uncertainty.

Organisational Structure for Risk Management

The organisational structure establishes the lines of accountability and authority for managing risk across business units. Most banks adopt a three lines of defence model:

- First line: Business units and front-line managers who own the risks in day-to-day activities.

- Second line: Independent risk management and compliance functions that set frameworks, monitor risks, and provide guidance.

- Third line: Internal audit, which independently reviews the effectiveness of risk governance and control mechanisms.

At the top, the Board of Directors oversees risk governance, supported by specialized committees such as the Risk Management Committee (RMC) and Audit Committee. Senior management, particularly the Chief Risk Officer (CRO), ensures operational execution of the enterprise-wide risk management framework.

Risk Management Policy

A bank’s risk management policy provides the overarching principles and guidelines to manage risk. It typically outlines:

- The scope of risks covered (credit, market, liquidity, operational, reputational, legal, and strategic risks).

- The governance structure defining roles and responsibilities.

- The methodology and tools for assessing, measuring, monitoring, and controlling risk.

- The reporting protocols to regularly update management and regulatory authorities.

The policy ensures consistency across functions while aligning with regulatory requirements and industry best practices.

Risk Appetite

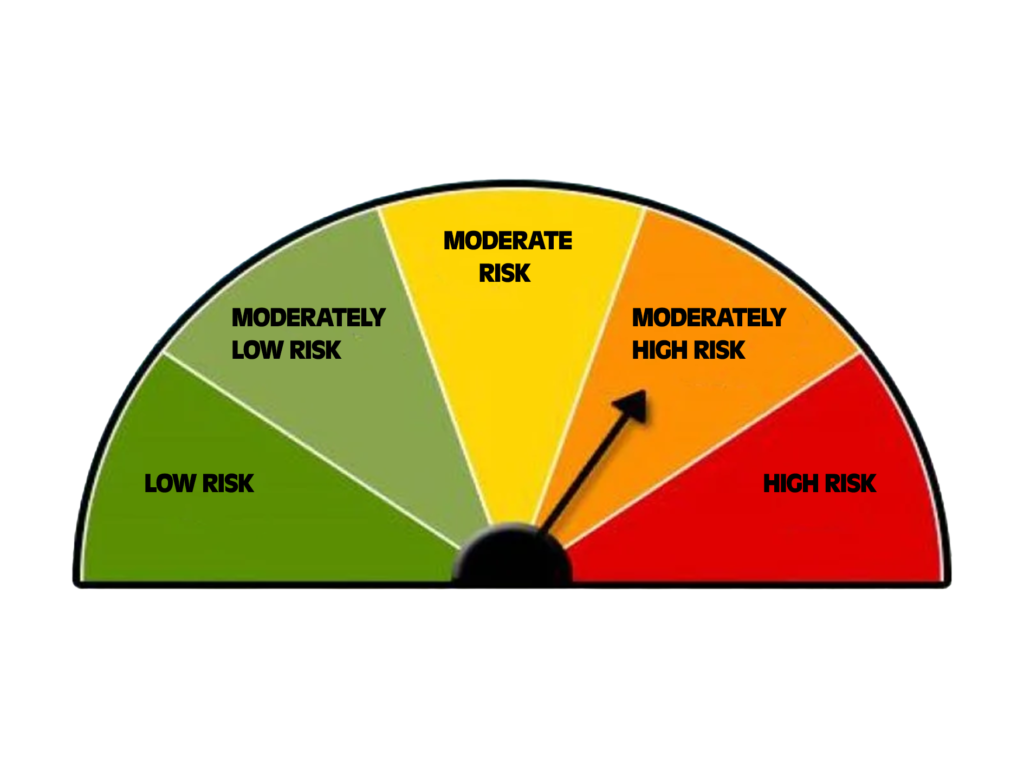

Risk appetite represents the amount and type of risk a bank is willing to assume in pursuit of its strategic objectives. It acts as a balancing mechanism between excessive conservatism and undue risk-taking. Typically, a board-approved risk appetite statement (RAS) includes:

- Quantitative measures, such as capital ratios, liquidity thresholds, and credit concentration limits.

- Qualitative factors, such as tolerance for reputational or ethical risk.

A well-articulated appetite statement ensures that risk-taking aligns with the bank’s vision, capital strength, and stakeholder expectations.

Risk Limits

Risk appetite is operationalized through risk limits. These limits define thresholds and boundaries for exposures at different levels: business units, portfolios, and even customers.

Examples of risk limits include:

- Maximum exposure to a single borrower or sector.

- Value-at-risk (VaR) levels for trading books.

- Liquidity coverage ratios for funding stability.

- Tolerance thresholds for operational losses or cyber incidents.

By establishing risk limits, banks translate broad appetite into actionable constraints that can be measured, monitored, and enforced.

Risk Identification Process

Risk identification serves as the first step toward proactive risk management. It helps organisations stay alert to emerging threats that may impact capital, earnings, or reputation. A comprehensive identification process includes:

- Internal analysis of processes, products, and systems to spot inherent risks.

- External scanning of macroeconomic factors, regulations, technological changes, and competitive pressures.

- Scenario analysis and stress testing to anticipate tail risks and extreme events.

- Stakeholder inputs from business units, customers, regulators, and auditors.

Effective identification ensures risks are recognized early, assessed, and either mitigated, transferred, or accepted within defined appetite levels.

Roles and responsibilities

- Board and Risk Committee: set appetite, culture, and oversee aggregate and emerging risks with regular reporting on adherence and exceptions.

- Senior management and CRO: translate appetite into policies, limits, and controls; ensure independence, stature, and enterprise-wide aggregation.

- First line (business): own identification, assessment, mitigation, and reporting of day-to-day risks consistent with policies and limits.

- Second line (risk/compliance): design frameworks, monitor metrics, challenge risk decisions, and maintain enterprise risk view.

- Third line (internal audit): provide independent assurance on effectiveness of governance, risk management, and controls.

Practical metrics and examples

- Credit risk: single-obligor and sectoral concentration limits; portfolio PD/LGD bands; early warning triggers and watchlist thresholds.

- Market risk: value-at-risk and stress loss limits for trading; interest rate sensitivity and FX open position caps.

- Liquidity risk: LCR/NSFR floors, cash flow mismatch buckets, survival horizon under stress.

- Operational/non-financial risk: loss event thresholds, KRIs for cyber and fraud, and change risk gates tied to product/process approvals.

Governance integration

An integrated framework connects risk culture, policies, appetite, limits, and reporting via strong MIS, with continuous monitoring and periodic holistic assessments (e.g., ICAAP linkages) to keep risk-taking within capacity. This integration enables timely escalation and corrective action when metrics breach thresholds, sustaining resilience and stakeholder confidence through cycles.

Conclusion

In today’s banking environment, risk is not just a challenge but also an opportunity. By building a resilient organisational structure, framing a robust risk management policy, defining appetite and limits, and strengthening the identification process, banks safeguard their stability and enhance stakeholder confidence. A sound risk culture embedded across all levels of the institution forms the ultimate shield against uncertainty.

Articles related to Risk Management in ‘Model ‘A’ of CAIIB –Elective paper: