In today’s dynamic financial environment, effective risk management has become a cornerstone for sustainable banking operations. Over the decades, global financial crises and domestic challenges have underscored the importance of structured risk frameworks. For banks and financial institutions, a well-designed risk management framework not only ensures regulatory compliance but also safeguards long-term stability and trust.

Lessons from Crisis

Financial crises, whether the Global Financial Crisis of 2008 or sector-specific credit collapses, have revealed two critical lessons: the dangers of ignoring systemic risks and the consequences of weak governance. Banks that lacked proactive risk oversight faced severe liquidity problems, capital erosion, and reputational damage. These experiences highlight that risk management cannot be reactive; it must be embedded into institutional strategy at every level.

Benefits of Risk Management

A strong risk management framework enhances resilience by:

- Reducing losses from unexpected events

- Safeguarding customer confidence and investor trust

- Ensuring compliance with regulatory and legal standards

- Optimising capital and improving resource allocation

- Enabling sustainable growth while taking calculated risks

Risk Management Concept

At its core, risk management refers to systematically identifying, measuring, monitoring, and mitigating potential threats that may impact a bank’s objectives. It encompasses financial risks (credit, market, liquidity) as well as non-financial risks (operational, compliance, reputational). The objective is not to eliminate all risks but to manage them within an acceptable range.

Risk Management Approach

The approach typically involves three steps:

- Prevention – reducing vulnerability by strengthening processes.

- Protection – developing safeguards against identified risks.

- Preparedness – creating contingency plans and recovery strategies.

Banks often adopt a layered “Three Lines of Defence” model, where frontline business units, risk management teams, and independent auditors together provide comprehensive oversight.

Risk Culture

Risk culture refers to the shared values, attitudes, and behaviours of employees toward risk-taking. A positive risk culture ensures:

- Transparency in reporting risks

- Accountability across all levels

- Alignment of incentives with prudent practices

- Ethical decision-making and integrity

Embedding a strong culture requires continual training, tone-from-the-top governance, and incentive structures that discourage excessive risk-taking.

Risk Management Architecture

The foundation of risk management lies in its architecture, which includes:

- Policies and Guidelines – to formalise procedures

- Organisational Structure – allocating responsibilities across roles

- Technology and Tools – for real-time monitoring and analytics

- Committees – such as risk management committees at the board and executive level

Elements of Risk Management Framework

A comprehensive framework generally includes:

- Risk governance mechanisms

- Risk identification and assessment processes

- Risk measurement methodologies

- Risk monitoring and reporting systems

- Control mechanisms and escalation procedures

Organisational Structure

Clear ownership of risk is vital. Modern banks establish:

- Board of Directors – oversight and setting overall risk appetite

- Risk Committees – guiding risk policies and monitoring limits

- Chief Risk Officer (CRO) – ensuring independent risk function

- Business Units – acting as the first line of defence

- Audit and Compliance Teams – validating processes and controls

Risk Management Policy

A documented policy provides direction and consistency across risk practices. It should define objectives, scope, roles, responsibilities, and procedures to ensure a uniform approach across the organisation.

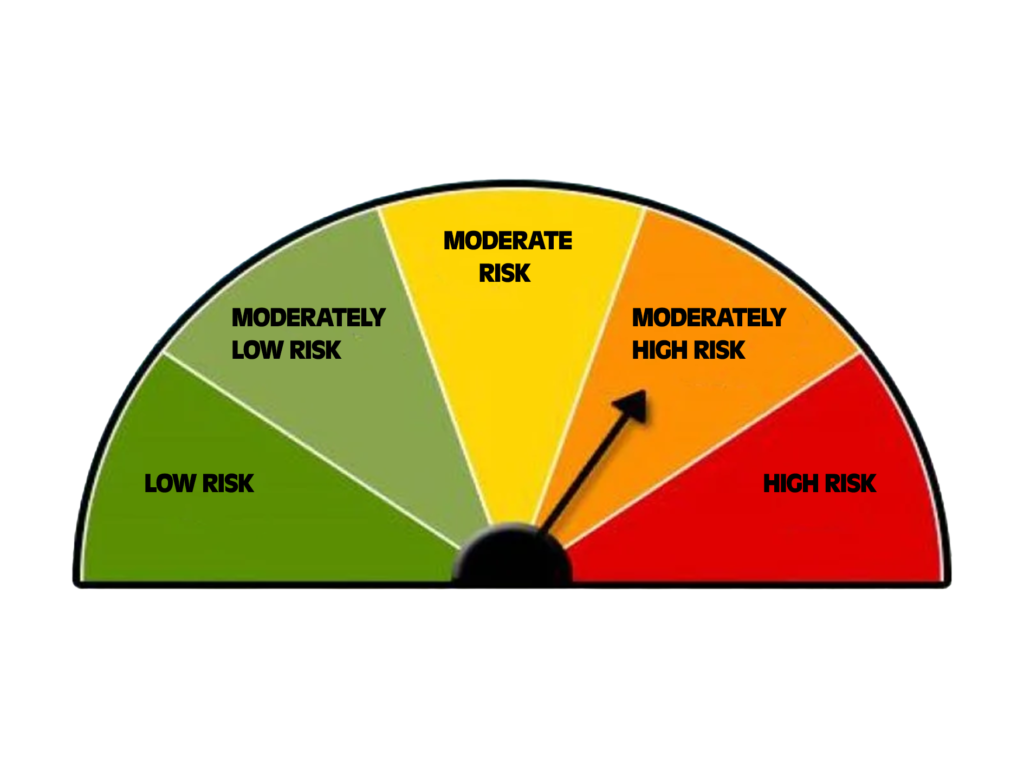

Risk Appetite

Risk appetite is the aggregate level of risk a bank is willing to accept to achieve its objectives. It balances growth ambitions with prudence, ensuring decisions remain aligned with long-term sustainability.

Risk Limits

Risk limits translate the overall risk appetite into specific, measurable thresholds across credit exposures, trading books, liquidity ratios, and operational events. These limits prevent concentration and overexposure in high-risk areas.

Risk Identification Process

The starting point of any framework is a structured process to identify risks across products, geographies, and business processes. This involves:

- Analysing internal and external environments

- Reviewing historical data of losses and near-misses

- Brainstorming with stakeholders and risk specialists

- Scenario analysis and stress testing

- Capturing emerging risks such as cyber threats and climate-related exposures

Conclusion

A well-designed risk management framework is integral to the stability and success of banking institutions. By learning from past crises, establishing clear structures, and cultivating a culture of shared responsibility, banks can manage uncertainties effectively while pursuing growth. Ultimately, robust risk management is not just a regulatory requirement but a strategic advantage in a highly uncertain world.

Articles related to Risk Management in ‘Model ‘A’ of CAIIB –Elective paper: