Risk-Based Internal Audit (RBIA): A Proactive Early Warning System for Banks

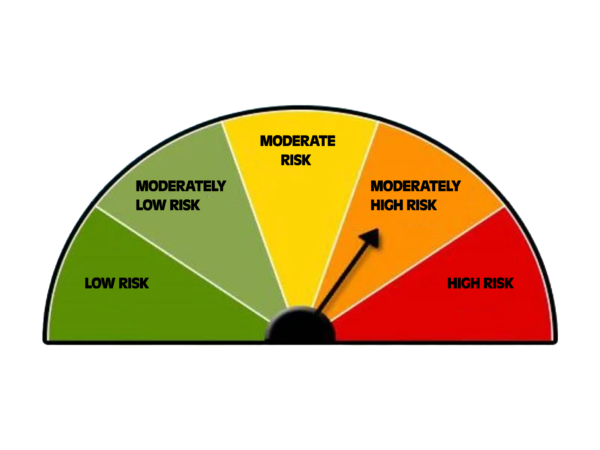

Risk-Based Internal Audit is a forward-looking methodology that aligns audit priorities with the enterprise’s top risks so assurance focuses on what truly matters for strategy, compliance, and resilience. It connects the audit universe, risk assessment, and audit plan to the organization’s risk appetite, delivering insight and early warning rather than after‑the‑fact findings. What is Risk-Based…