The working capital requirement of industrial and trading establishments refers to the total funds invested in various current assets such as raw materials (RM), work-in-process (WIP), finished goods (FG), and outstanding receivables. Banks extend working capital facilities to borrowers based on the nature and level of current assets, after deducting the borrower’s margin contribution, within the overall permissible bank finance.

Let us understand the key terms commonly used in working capital appraisal.

1. Current Assets

Current assets are those assets that can be converted into cash within one year from the balance sheet date. They include cash and cash equivalents, as well as other short-term assets such as:

– Raw materials (RM)

– Work-in-process (WIP)

– Finished goods (FG)

– Trade receivables or debtors

These assets represent the short-term resources available to a business to meet its day-to-day operational requirements.

2. Current Liabilities

Current liabilities represent the short-term obligations or debts that are payable within twelve months from the balance sheet date. Examples include:

– Accounts payable to sundry creditors

– Payroll liabilities

– Current portion of long-term loans due within a year

– Dividends payable

These liabilities reflect the short-term commitments that a company must settle during its operating cycle.

3. Meaning of Working Capital

Working capital refers to the total capital invested in a company’s operating cycle. It represents the funds required for the day-to-day operations of a business, such as purchasing raw materials, paying wages, and meeting other short-term expenses.

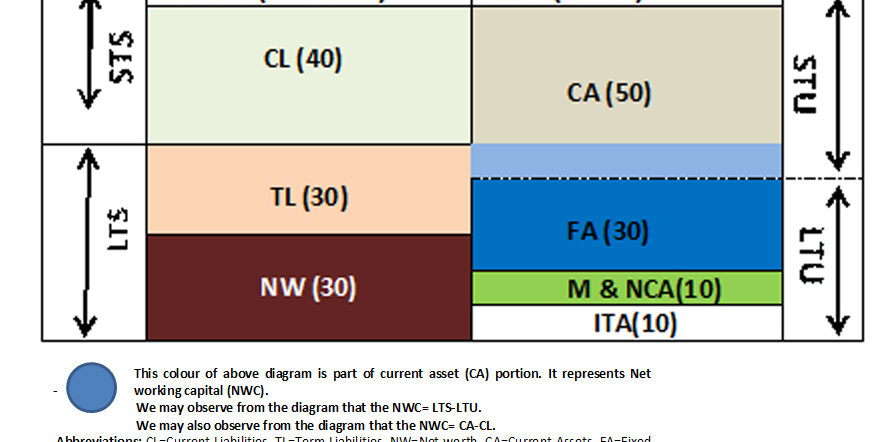

4. Gross Working Capital and Net Working Capital

Gross Working Capital (GWC) refers to the total investment in current assets.

Net Working Capital (NWC) is the difference between current assets and current liabilities:

NWC = Current Assets – Current Liabilities

NWC represents the portion of current assets financed by long-term funds. A change in total current assets affects the gross working capital, but NWC changes only when the variation in current assets and current liabilities is not identical. For instance, if both increase by the same amount, NWC remains unchanged.

5. Working Capital Gap

The working capital gap (WCG) represents the portion of current assets that is not financed by current liabilities. It shows the funding requirement that needs to be met either through the business’s own long-term funds or through bank borrowings.

WCG = Current Assets – Current Liabilities

6. Significance of Working Capital Gap

The working capital gap is crucial for determining how much of the short-term requirement can be financed from internal long-term sources (NWC) and how much needs to be financed through bank credit. Hence, for proper assessment of working capital limits, banks first appraise:

– Gross Working Capital

– Net Working Capital

– Working Capital Gap

This analysis helps in determining the borrower’s contribution and the extent of bank finance required.

7. Operating Cycle

The operating cycle refers to the time taken to convert non-cash current assets—such as raw materials, WIP, finished goods, and receivables—into cash. A shorter operating cycle indicates efficient working capital management, while a longer cycle may suggest funds are tied up for extended periods in the production and sales process.

8. Net Worth of the Company

The net worth (NW) of a company represents the excess of total assets over total outside liabilities. It reflects the shareholders’ funds in the business and typically comprises:

– Share capital

– Reserves and retained earnings

In simple terms:

Net Worth = Total Assets – Total Outside Liabilities

Net worth serves as a measure of the company’s financial strength and long-term solvency.

Related Posts: