The terms ‘bills purchase’,’ bills discount’, and ‘bills negotiation’ are respectively used by the bank for financing against ‘Demand Bills’,’Usance Bills’, and LC bills. The seller of goods (exporter) gets immediate money from the bank for the goods sold by him irrespective of whether it is a purchase, discount, or negotiation by the bank according to the nature of bills.

For an importer, original shipping documents are required for the purpose of taking delivery of goods shipped to him by the exporter. To enable the importer to take delivery of the cargo shipped to him, the exporter after shipment of goods prepares the necessary set of documents like commercial invoice, packing list, certificate of origin, quality certificate, Bill of lading/Airway bills, dock warrant, dock receipt, warehouse receipt, etc. along with the order for the delivery of title to goods. The set of documents so prepared will be submitted by the exporter to his bank for onward transmission of documents to the importer’s destination, with an instruction to collect the invoice amount of goods dispatched by him under contracted terms.

DP Bills (Documents against Payment)

The bill of exchange drawn by the exporter (seller) can be against ‘Sight payment’ which means the documents sent by the exporter will be delivered to the importer (buyer) against payment of bill amount (DP terms).

Usance Bills

The other type of bill is under ‘Usance terms’ where the bill shall be payable by the drawee (buyer) at a specified period ‘after date’ or ‘after sight ’of the bill (DA terms). (The term ‘after date’ means the due date will be calculated from the date of the bill. The term ‘after sight’ means the due date will be calculated from the date of presentation of the bill). In the case of ‘Usance bills’, the documents are delivered to the buyer against the acceptance of bills by the drawee. The importer’s bank notifies the buyer for ‘acceptance of bills’ and allows the importer to take the delivery of the documents of title to goods against the acceptance bill.

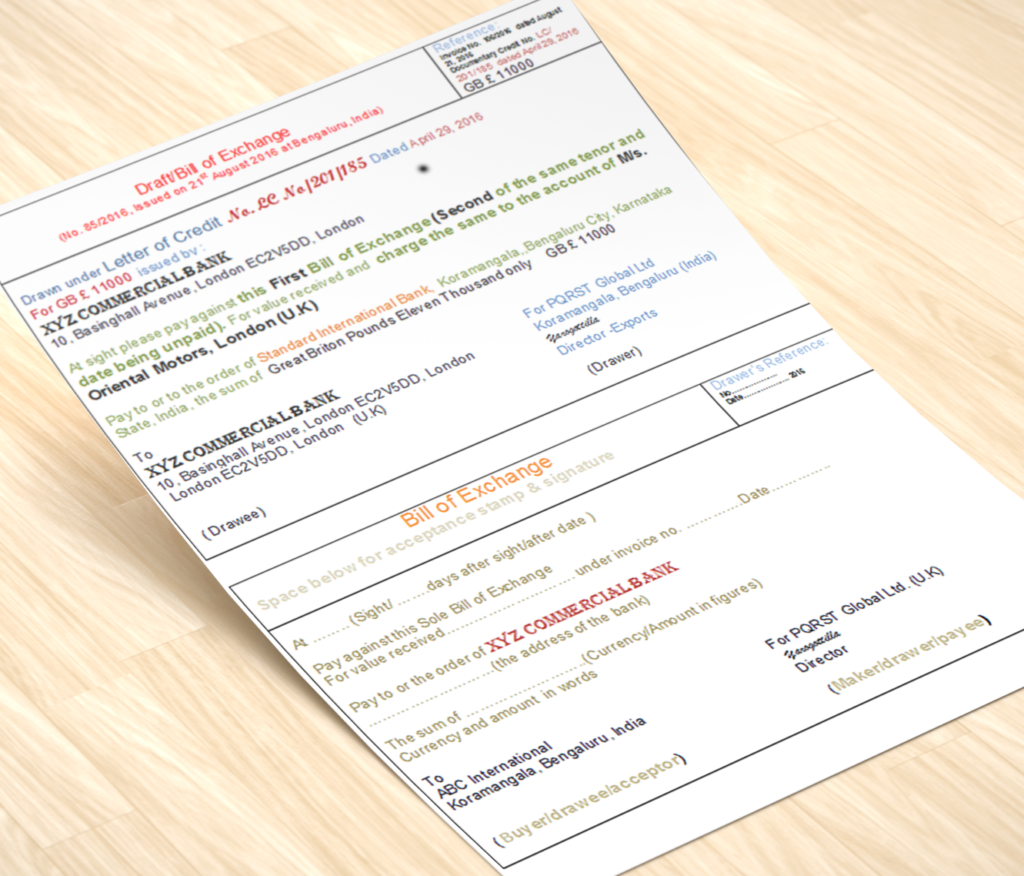

Bills under Letter of Credit

The LC bills can be either the sight bill or under Usance terms, but in the case of LC bills, the drawee (importer’s) bank is under the obligation to pay the bill amount to the exporter (seller) or bill negotiating bank if the documents forwarded by the exporter meet all necessary requirements under terms of Letter of Credit (LC).

Usually, the banks accept only documentary bills for purchase as the clean bills do not possess the title to goods, and therefore purchasing clean bills is not safe. However, the purchase of clean bills from good parties also permitted by banks based on sanction terms of the limit. Besides charging normal interest applicable for such advance from the date of finance till the date of payment of the bill, banks collect normal commission postages and exchange charged on those bills sent for collection. The interest collected by the bank for the usance period of the bill is called ‘Discount’ income.

Click below for related articles:

- Checklist for banks financing LC/ co-accepted bills

- Meaning of inland bills and foreign bills

- Meaning of DP bills, DA bills, and Acceptance of Bills,

- What is co-acceptance of bills?

- What are the Clean Bill, Documentary bill, Demand bill, Usance Bill, and Accommodation Bill

- Crystallization of overdue export bills

- Crystallization of Import LC bills

- Post shipment finance to exporters without packing credit facility

- How to liquidate packing credit loan without post-shipment finance?

- Meaning of Normal transit period and notional due date

- What is forfaiting

- What is International factoring?