Checklist for banks financing against LC/ Co-accepted bills

Letter of credit (LC) is an undertaking from a bank on behalf of its customer (importer/buyer) wherein the beneficiary (exporter) is fully assured of payment provided he fulfills his part of the sale contract embodied in Letter of Credit. Similarly, Co-acceptance of bills means “an undertaking from the third party (generally a Bank) to make payment…

Read articleWhat is the meaning of inland bills and foreign bills?

Meaning of Inland Bills; A bill of exchange which is drawn or made in a country and paid in the jurisdiction of the same country is called inland bill. The section 11 of Negotiable Instrument Act 1881 provides that the bills of exchange (including cheques/promissory notes) drawn or made in India and made payable in or…

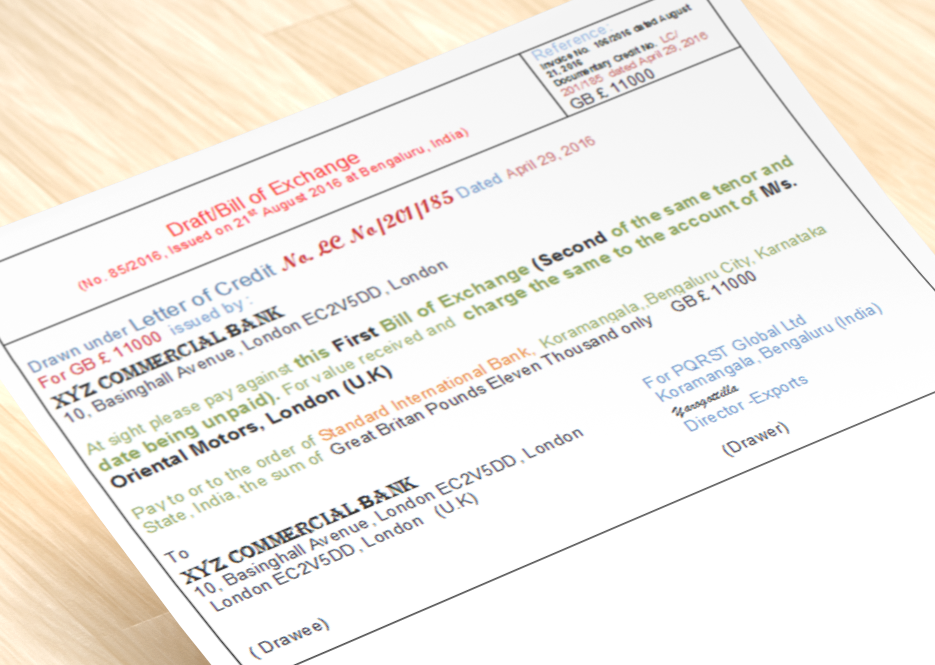

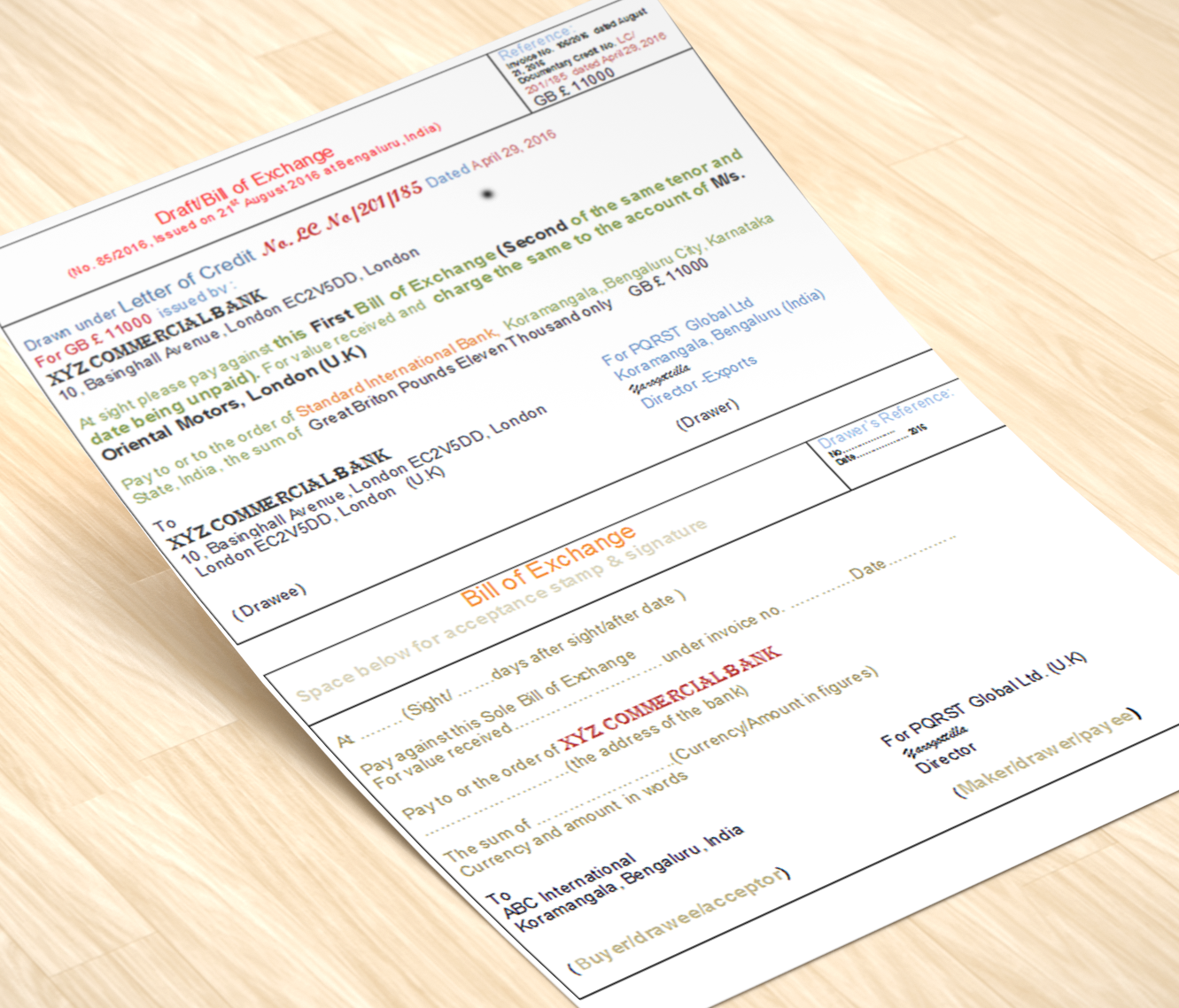

Read articleWhat is the meaning of DP bills, DA bills, and Acceptance of bills?

A buyer of goods requires original shipping documents to take delivery of goods shipped to him by the seller. The seller (exporter) after shipment of goods prepares necessary set of documents related to goods like Bill of lading/Airway bills, LR, RR, dock warrant, dock receipt, warehouse receipt, etc. along with the invoice of the goods…

Read articleSweeping amendments in FDI rules

The Government of India introduced major changes in FDI policy on Monday, Jun 20, 2016, bringing most sectors and activities under the automatic approval route. The changes introduced now simplifies the regulations governing foreign investments, and increase sectoral caps with a small negative list. These amendments are the second sweeping changes in FDI policy after…

Read articleThings to know about FDI

(The importance of FDI is explained in this article in questions and answers format. The questions are like What way FDI is useful to domestic economy?, Why overseas entities invest in other countries?, Why India attracts FDI?, Why shop-keepers, businessmen and some political parties in India oppose FDI?, Is there any restriction for FDI?, What…

CCIL is now Trade Repository

The Clearing Corporation of India Limited (CCIL) is now designated as ‘Trade Repository’ for the OTC interest rate and Foreign Exchange Contract. The designated trade repository will be regulated and supervised under section 34(2) of the Payment and Settlement Systems Act, 2007 (PSS Act). Being a Financial Market Infrastructure (FMI), the repository would function under…

Read article