Understanding the documents that are mandatory in India for export and import

In the year 2015, the World Bank ranked India at 123 in the ‘Trading across Borders” component of “Ease of Doing Business”, out of 189 countries. In view of facilitating ease of doing business in our country, the Government of India simplified the mandatory documents for exports and imports. The DGFT’s Notification dated 12-3-2015, made…

Read articleWhat is negative statement of export bills?

Where exports made under the Duty Drawback Scheme and such bill remain outstanding beyond the prescribed time limit, the exporter needs to submit a negative statement/certificate to the nodal officer of Department of Excise and Customs on a 6 monthly basis. The negative statement /certificate will be issued either by the authorized dealer (AD) bank(s)…

Read articleComparative overview: Purchase, Discount and Negotiation of export bills

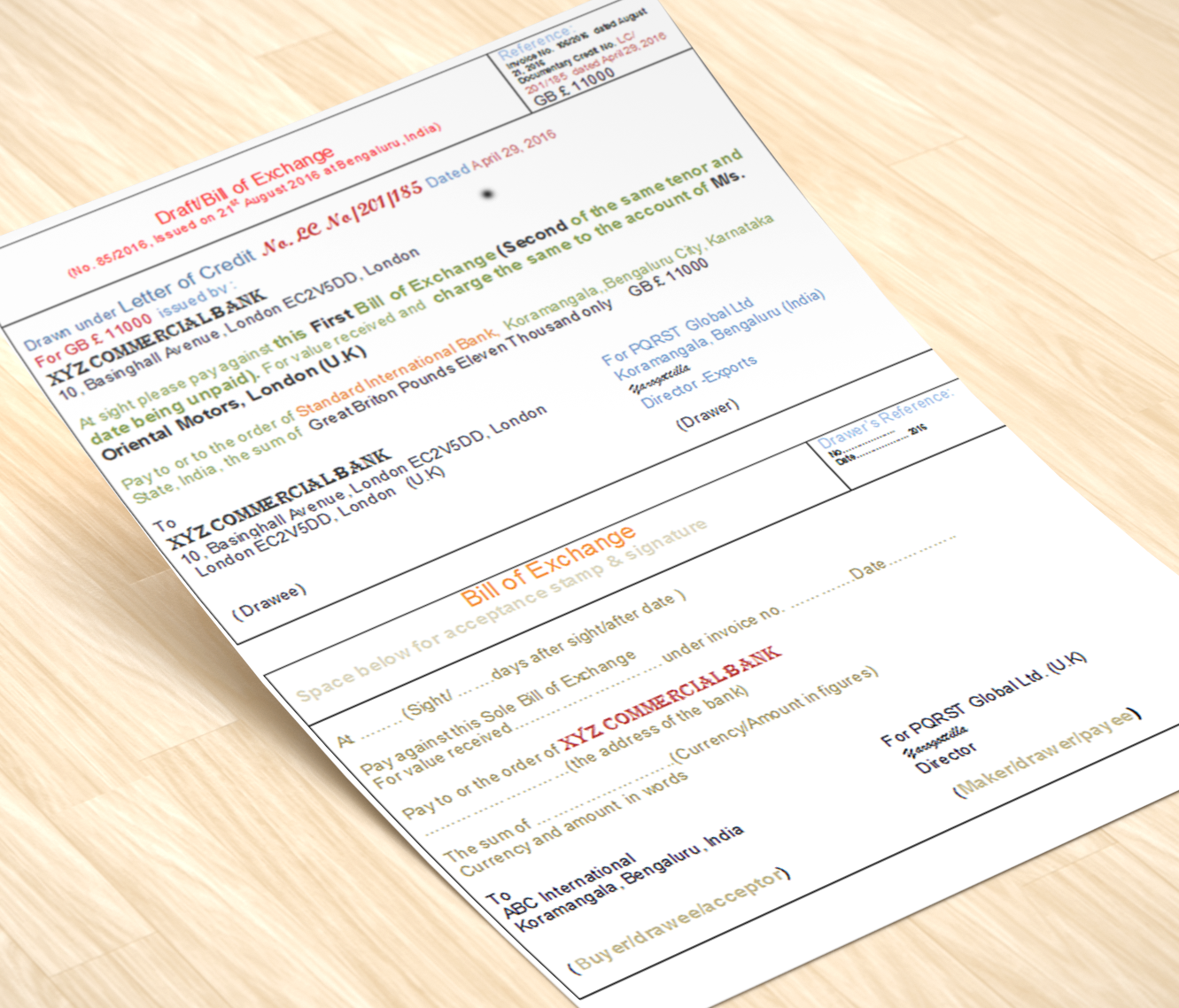

The terms ‘bills purchase’,’ bills discount’, and ‘bills negotiation’ are respectively used by the bank for financing against ‘Demand Bills’,’Usance Bills’, and LC bills. The seller of goods (exporter) gets immediate money from the bank for the goods sold by him irrespective of whether it is a purchase, discount, or negotiation by the bank according…

Read articleRBI sets up additional arrangement for settlement of exports / imports in INR

Reserve Bank of India on Monday said it has been decided to put in place an additional arrangement for invoicing, payment, and settlement of exports/imports in INR. All Category-I Authorised Dealer (AD) banks shall require prior approval from the Foreign Exchange Department of Reserve Bank of India, Central Office at Mumbai, before putting in place…

Read articleRBI permits Opening of additional Current Account in Indian Rupees for exports proceeds

The Reserve Bank of India (RBI) on Friday permitted banks to open additional current account for exports proceeds in addition to special rupee vostro accounts with a view to provide greater operational flexibility to exporters.In terms of this provision and in order to provide greater operational flexibility to the exporters, AD Category-I banks maintaining Special…

Why an exporter needs ECGC cover

An exporter needs ECGC cover for the risk of non-payment by the buyer. The risk of non-payment may be due to political and economic changes all over the world. Political changes like an outbreak of war, civil war, a coup or an insurrection may block or delay payment for goods exported. Likewise economic difficulties or…

Read article