Some Notable Cases Pertaining to the PMLA Act: Insights for Banking and Legal Enthusiasts

The Prevention of Money Laundering Act (PMLA) has been a powerful tool in combating financial crimes in India. Several landmark cases have helped shape the interpretation and enforcement of this legislation. This article highlights some crucial cases that put a spotlight on the complexities and evolving jurisprudence around PMLA. 1. Vijay Madanlal Choudhury v. Union…

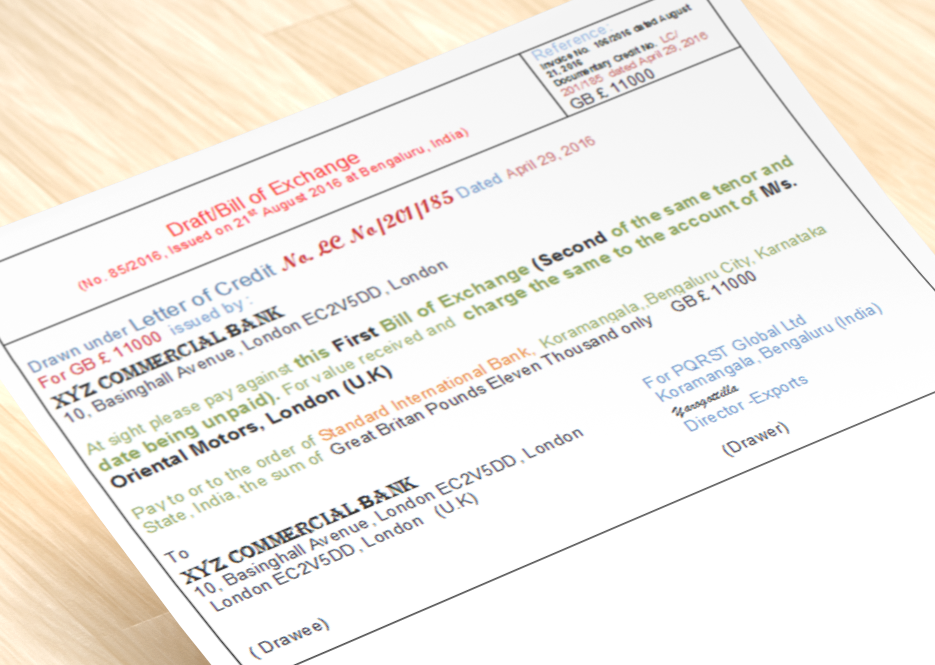

Read articleUnderstanding some important terms related to bills of exchange

A Bill of exchange is a written, unconditional order by one party (the drawer) to another party (the drawee) to pay a specified sum of money to a third party (the payee) at a predetermined date or on demand. The bill of exchange serves as a promise to pay and acts as a credit instrument,…

Read articleWhat is a forged instrument? (Cheque/bill/Promissory note)

A negotiable instrument like a cheque, bill of exchange, or promissory note is called a forged instrument when forgery takes place in the signature of the drawer, the signature of the endorser, alteration in name of the payee, alteration in amount, alteration in date, etc. If the forged endorsement is a nullity, then it will…

Read articleProtection available to Collecting banker and responsibility of collecting banker

A banker collects a cheque for his customer in the capacity of an “agent for collection”, the banker collects the cheque on behalf of his customer, which also when presented to him. If a customer gives an open cheque i.e. a cheque uncrossed, the banker has to cross the cheque before it is sent for…

Read articleMeaning of valid endorsement and endorsement of a cheque

Section 15 of NI Acts 1881 defines endorsement (Indorsement) as under When the maker or holder of a negotiable instrument signs the same, otherwise than as such maker, for the purpose of negotiation, on the back or face thereof or on a slip of paper annexed thereto, or so signs for the same purpose a…

Cheque bouncing and consequences of dishonour of Cheque explained

Although, there are several cheque bounce reasons to be considered such as incorrect date mentioned on the cheque, signature mismatch, mismatch of the amount and figures, damaged cheque, overwriting of the cheque, etc. The principal reason for a cheque bounce is insufficient funds. If a cheque is dishonoured because of insufficient funds in the payer’s…

Read article