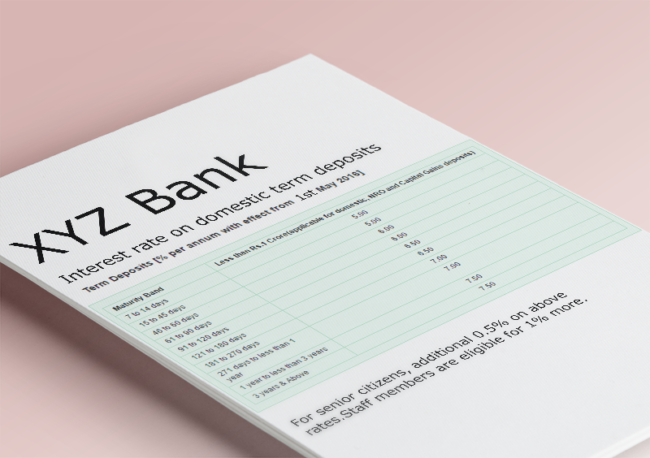

RBI announces Scheme of Reconstruction for YES bank

The Yes Bank Ltd. was placed under an order of moratorium on March 5, 2020 which will be effective up to April 3, 2020.In this regard, RBI published a draft scheme of reconstruction of the Yes Bank Ltd.in public domain inviting suggestions and comments from the public as well as all the stake holders of…