What is Credit Scoring and What is a Good Credit Score?

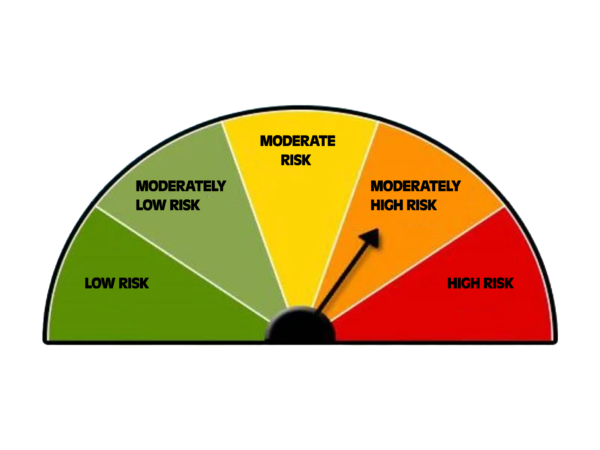

Credit scoring is a method used by lenders to evaluate a person’s creditworthiness—that is, how likely they are to repay borrowed money. This evaluation is usually expressed as a three-digit number, commonly known as a credit score. It is based on an individual’s credit history and financial behavior. Credit Score vs. Credit Rating There’s often…