Foundations of Risk and the Basic Risk Management Framework

IntroductionRisk, in the context of business and organizational operations, refers to the potential for loss, damage, or adverse consequences resulting from uncertain events or conditions. It signifies the possibility that undesirable outcomes may impact various facets of an organization, including its financial performance, operational continuity, regulatory compliance, and reputation. To address these uncertainties effectively, organizations…

Read articleThe threshold limit for Small Business Customers increased to align with the Basel III framework: RBI

In order to protect depositors from the risk of a bank becoming insolvent, the banking regulator has prescribed banks and other authorised financial institutions to fund themselves with a minimum amount of capital (CAR) in terms of Basel III Framework on Liquidity Standards – Liquidity Coverage Ratio (LCR), Liquidity Risk Monitoring Tools and LCR Disclosure…

Read articleHow are Credit metrics and credit migration risk use in financial analysis?

In this article, we’ll explain what credit migration risk and credit metrics are, and how to incorporate them into the financial analysis of companies by lenders and investors. Credit Migration risks: Credit ratings for public companies or Governments are similar to credit scores for individuals. These ratings for the long-term and short-term are provided by…

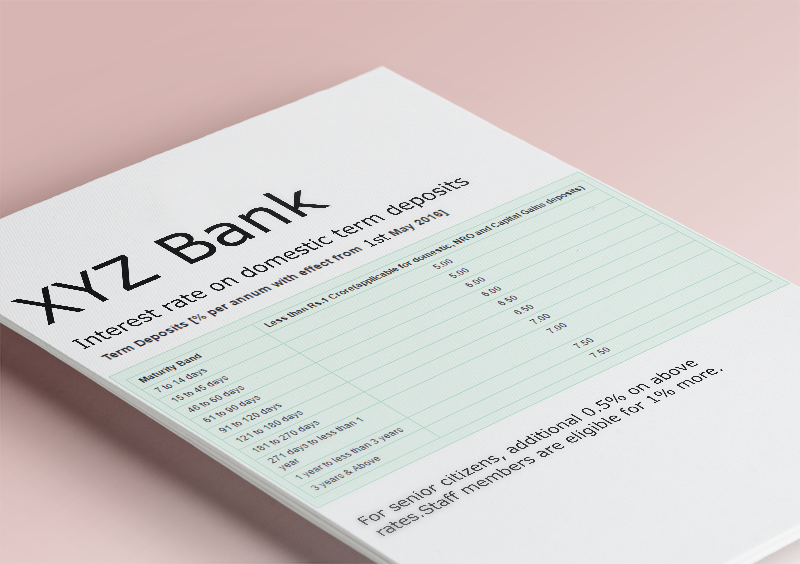

Read articleInterest rate risk definition and impact on banking book

Interest rate risk is the potential for investment losses that can be prompted by a move upward in the prevailing rates for new debt instruments. Interest rate changes can affect many investments, but it impacts the value of bonds and other fixed-income securities most directly. As interest rates rise bond prices fall, and vice versa.…

Read articleRegulatory Basel III Framework on Liquidity Standards for reckoning Liquidity Coverage Ratio (LCR)

RBI on Monday July 21, 2025 through notification announced that “it has been decided to permit banks to reckon Government securities as Level 1 HQLA* under FALLCR** within the mandatory SLR requirement up to 16 percent of their NDTL, under Basel III Framework on Liquidity Standards. Consequently, the total HQLA carve-out from the mandatory SLR,…

RBI issues M D on Minimum Capital Requirements for Operational Risk

The Reserve Bank of India has today (June 26, 2023) issued the Master Direction on Minimum Capital Requirements for Operational Risk. The Central Bank said that the circular is issued after appropriately considering the feedback received from stakeholders. According to the Directions require all specified Commercial Banks (excluding Local Area Banks, Payments Banks, Regional Rural…

Read article