Banking Ethics in Global and Indian Contexts

Globally Banking ethics rely on rules and standards that govern the conduct of a bank and its employees, and the impact of the bank’s actions on society and the environment. Banks are running on strong foundations of following four ethical principles which help them to deal with ethical issues. Principles of Trust: The Principles of…

Read articleWhat is debt service coverage ratio (DSCR)?

The debt service coverage ratio (DSCR) is a method to compares a business’s level of cash flow to its multiple debt obligations including proposed term loan installments. Lenders typically calculate DSCR by dividing the business’s annual net operating income by the business’s annual debt payments. DSCR less than 1 suggests a negative cash flow, and…

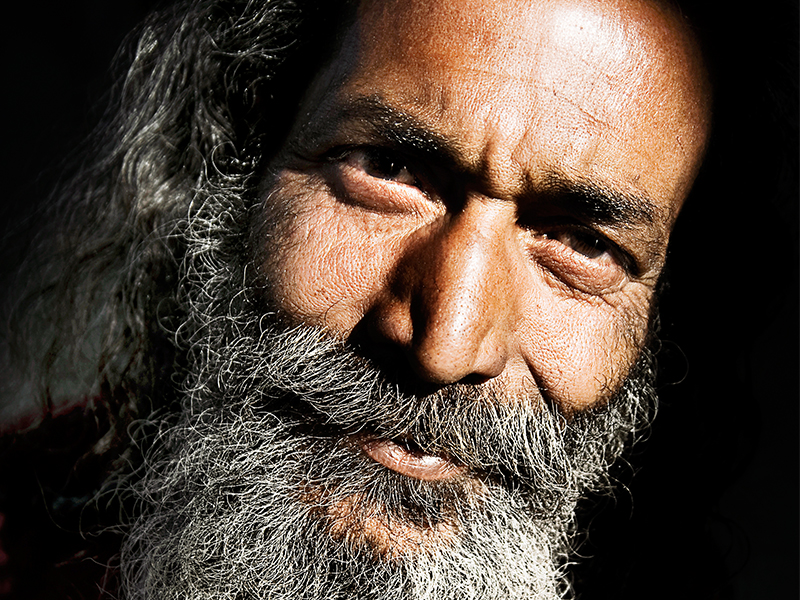

Read articleWhat is Ethics?

The word “ethics” is derived from the Greek word ethos (character), and the Latin word mores (customs). In the legal context, ethics defines how individuals choose to interact with one another. According to Aristotle Ethics is the study of character, habits, and virtues that can be acquired through practice that enables us to lead a…

Read articleWhat is a Phishing?

Phishing is an e-mail-borne fraudulent attempt to obtain confidential information from the recipient such as usernames, passwords, and credit card details by disguising oneself as a reliable entity or downloading malware by clicking on a hyperlink in the message. Scammers impersonate legitimate organisations (banks, government agencies) through emails, SMS, or phone calls, contact people, and…

Read articleOverview of the IT Act: Gopalakrishna Committee Recommendations

The Gopalakrishnan committee is a committee of experts on the concept of non-personal data (NPD) constituted by the Ministry of Electronics & Information Technology (MeitY). The stated goals for the committee were (i). To study various issues relating to non-personal data (NPD). (ii). to make specific suggestions for consideration of the Central Government on the…

How to analyse a Cash flow statement?

The Cash flow statement represents the increased or decreased position of cash and cash equivalents in a business. In a way, it is useful in assessing the company’s ability to meet its short-term obligations. Cash equivalent means highly liquid current assets which can be readily converted into cash without any loss in value or time.…

Read article