Govt hikes interest rate 0.1% to 0.3% on small savings schemes for Q3 of FY23

The government on Thursday has effected minor hikes of 0.1% to 0.3% in interest rates payable on five small savings instruments out of a bucket of 12 instruments, including Kisan Vikas Patra, Senior Citizens’ Savings scheme, and time deposits for two and three years, for the quarter beginning 1 October. The previous change of interest…

Read articleLatest Small Savings/Post Office Interest Rates October-December 2022

Updated: September 30, 2022 The government on Thursday has effected minor hikes of 0.1% to 0.3% in interest rates payable on five small savings instruments out of a bucket of 12 instruments, including Kisan Vikas Patra, Senior Citizens’ Savings scheme, and time deposits for two and three years, for the quarter beginning 1 October. The…

Read articlePremium payable by bank retirees for Group Medical Insurance Policy 2022-23

The Indian Banks’ Association (IBA) communicated to all member banks informing them that National Insurance Company has been allotted the Group Medical Insurance Policy 2022-23 for the bank retirees. According to the communication received by banks, the National Insurance Company has sent their revised rates for Flexible Option coverage of Sum Insured for the year…

Read articleRBI modifies Master Directions for Interest Rate on Deposits

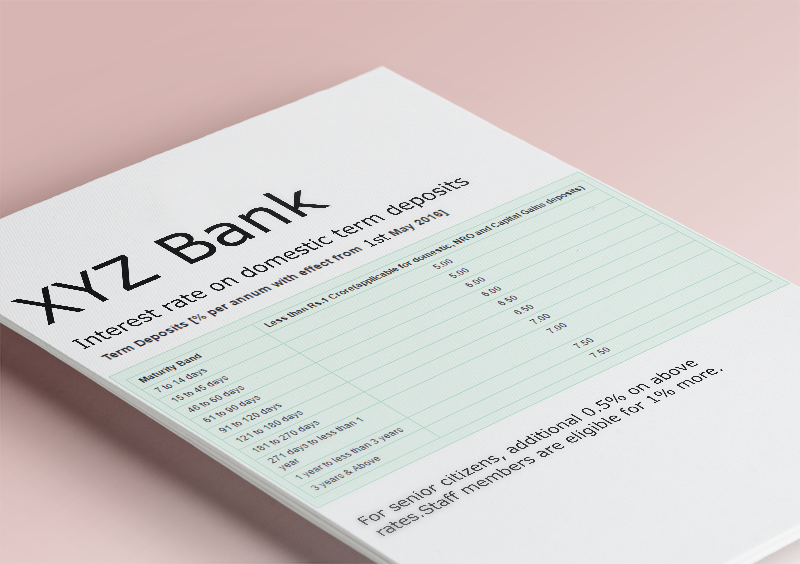

RBI on Friday (September 16, 2022) notified that its master direction dated March 03, 2016, on interest rates on deposits and May 12, 2016, on ‘Co-operative Banks – Interest Rate on Deposits’ have been modified. Further, the instructions regarding eligibility for the opening of savings account contained in Section 28 (h) and Section 27 (h)…

Read articleYou will earn 75.49 % return on premature redemption of the Sovereign Gold Bond series-IV

The Reserve Bank of India has announced that the second due date of premature redemption of the Sovereign Gold Bond (SGB) 2016-17, Series IV shall be September 17, 2022. As per the Government’s notification on SGB 2016-17 Series IV, the tenor of the bond is 8 years and early encashment/redemption of the bond is allowed…

IRDAI relaxes the NPS norms: Done away with the requirement of submitting a separate form to buy annuity from NPS proceeds at the time of retirement

Insurance regulator IRDAI on Tuesday (13.08.2022) said it has done away with the requirement of submitting a separate form to buy an annuity from NPS proceeds at the time of retirement.To bring ease of living for senior citizens, IRDAI has relaxed the requirement of submitting a separate proposal form for taking the immediate annuity products…

Read article