Bank finance of different types

(This posts elucidates different types of credit facilities extended by the banks) You may be aware that banks lend various types of credit facilities to their customers viz.Demand Loans, consumer loans, home loans, education loans, term lending, working capital finance, export credit, Bank Guarantee, Letter of credit, etc. Bank finance to their customers is not…

Read articleWhat are secured and unsecured loans?

There are two basic types of loans granted by lenders namely Secured and Unsecured loans. The secured loans are those loans which are granted by the lenders taking security from the borrower against the loan. The security may be prime security or collateral security.Prime security is an asset acquired by a borrower under a loan…

Read articleConversion of debt into equity by the Asset Reconstruction Companies reviewed

At present, the Asset Reconstruction companies viz. the Securitization Companies / Reconstruction Companies (SC/RCs) are permitted to convert a portion of debt into shares of the borrower company as a measure of asset reconstruction subject to a condition that their shareholding does not exceed 26% of the post converted equity of the company under reconstruction.…

Read articleWhat are the activities of a commercial bank?

The core business of a bank is to accept deposits from the public for the purpose of lending and investment. The Section 5(b) of the Banking Regulation Act, 1949, provides that “banking” means the accepting, for the purpose of lending or investment, of deposits of money from the public, repayable on demand or otherwise, and…

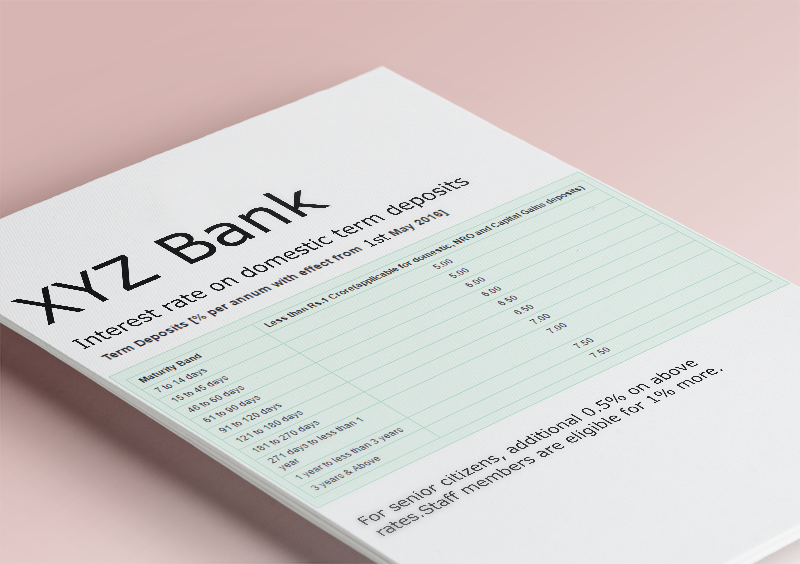

Read articleBanking Facility for Senior Citizens and Differently abled Persons

RBI in its circular RBI/2017-18/89 /DBR.No.Leg.BC.96/09.07.005/2017-18 dated November 9, 2017 observed that there are occasions when banks discourage or turn away senior citizens and differently abled persons from availing banking facilities in branches. In this regard, Developmental and Regulatory Policies, released by Reserve Bank of India on October 4, 2017 state that notwithstanding the need…

What is Legal Entity Identifier (LEI) ?

Updated 05.01.2021: LEI is a 20-digit unique code to identify parties to financial transactions worldwide. Following the global financial crisis, the Legal Entity Identifier (LEI) code is conceived at the initiative of the ‘Group of 20, financial stability Board’. In the US and Europe, the regulations require the use of LEIs to uniquely identify counterparties…

Read article