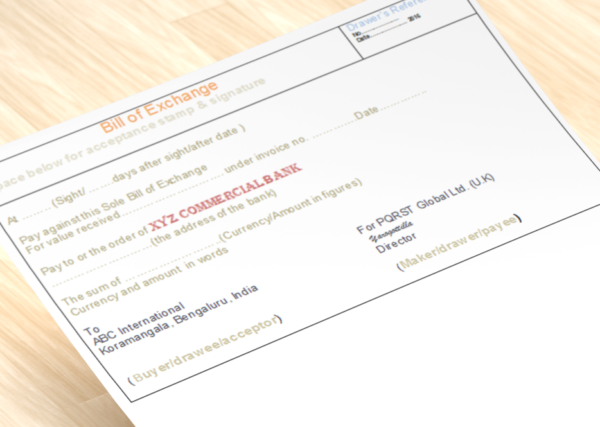

Understanding Documentation Procedure and stamping in Banks

It is inevitable for banks to ascertain that bank could easily take possession of such security based on documents obtained from the borrower with very little expenses and dispose-off the same to recover its dues when the account goes bad. Banks obtain ‘Different Types of Documents‘ from the borrower based on the type of security…