What is an accommodation Bill?

Generally, a bill of exchange is drawn by a creditor on his debtor to settle a trade debt. A creditor is a person who has sold goods on a credit basis and a debtor is a person who has purchased goods on a credit basis. Thus, a bill that is drawn by a creditor and…

Read articleWhat are Business earnings, how they are computed?

As we all know, earnings is basically net income after tax or bottom line which determines a business entity’s share price. The earnings of a business entity also provide financial analyst certain yard stick to evaluate the financial condition and performance of a business. The earnings also reflect whether actual performance is good to the…

Read articleGovt. plans to upgrade PAN card to PAN 2.0

The Cabinet Committee on Economic Affairs (CCEA), chaired by Prime Minister Shri Narendra Modi, On November 25, 2024, announced its approval for the PAN 2.0 Project of the Income Tax Department with a financial implication of Rs.1435 Crore. PAN 2.0 Project is an e-Governance project for re-engineering the business processes of taxpayer registration services through…

Read articleWhat is a Bill book in accounting?

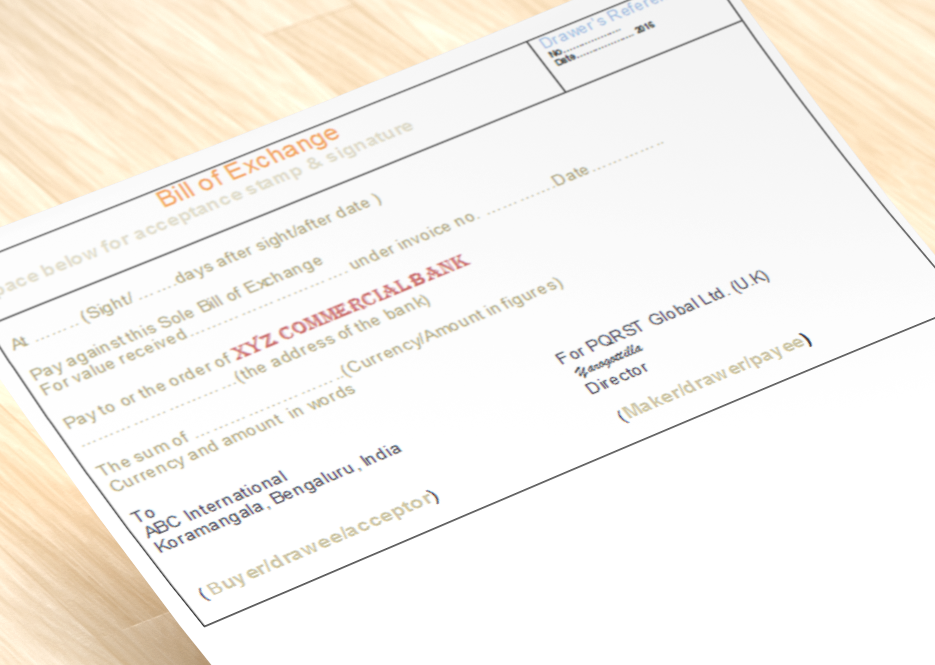

A book in which an account of bills of exchange and promissory notes, whether payable or receivable, is stated is known as bill book. There are two types of billbooks in accounting: A bill payable book is an accounting ledger that records and tracks a company’s outstanding bills and payment obligations. It helps businesses manage…

Read articleBANK HOLIDAYS 2025: TAMIL NADU

The Tamil Nadu government has announced a list of 23 days as public holidays in 2025 under the Negotiable Instruments Act, 1881, which will be applicable to State government offices, its undertakings, corporations, and boards, among others. List of Public Holidays 2025 Sr.No Date Day Occasion/Festival Date 1 01.01.2025 Wednesday NEW YEAR’s DAY 2 14.01.2025…

Distinction between Capital Receipt and Revenue Receipts

There are two different types of receipts that a business or a government generates during its financial activities. They are called capital receipts and revenue receipts. Capital receipts are funds that a company, organization, or government receives from non-operational sources, such as the sale of assets, borrowing, or equity investments. They are typically non-recurring transactions…

Read article