ALCO and ALM systems in banks explained

This post elucidates Asset Liability Committee (ALCO) that evaluates the risk associated with Assets and Liability of banks, financial institutions and also the practice of managing risks that arise due to mismatches between the assets and liabilities known as Asset Liability Management (ALM). ALCO (Asset Liability Committee): A risk management committee in a bank that…

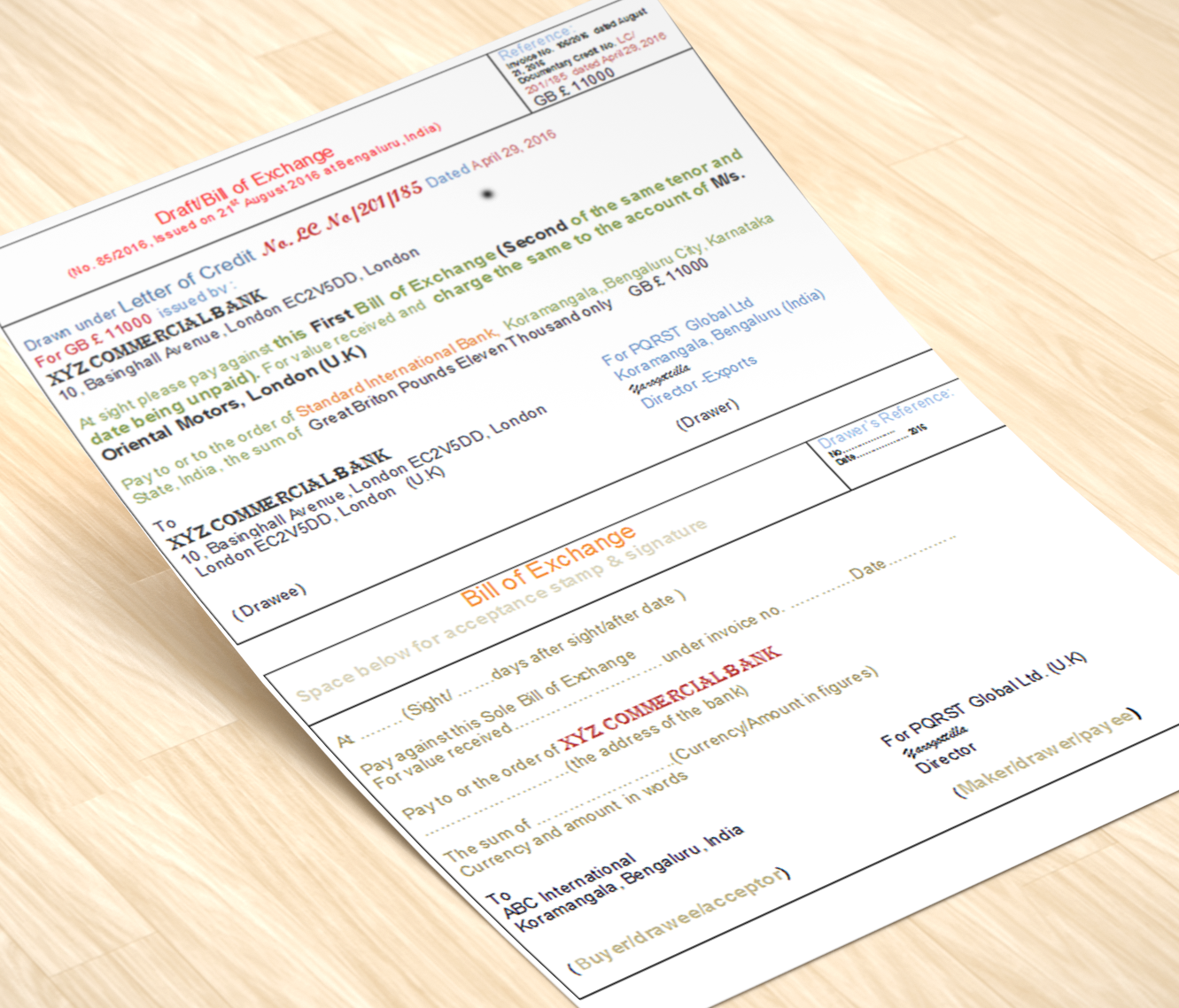

Read articleDocumentary Collection system in international trade explained

Documentary Collection or bill collection refers to the collection of financial and/or commercial documents. The documentary collection is one of the conventional methods of payment in international trade whereby the seller forwards financial and/or commercial documents to the buyer through his bankers against cash payment or acceptance of a bill of exchange. Unlike a bill…

Read articleRBI hesitates to bite the bullet, REPO rate remains intact

October 5, 2018: The Monitory Policy Committee (MPC) of Reserve Bank of India in its Fourth Bi-Monthly Statement for 2018-19, announced today did not increase the policy repo rate as widely expected. There was a time when banks followed closely on the heels of what the central bank did, i.e., when it raised rates, lenders, too,…

Read articleHow banks measure credit risk?

Credit risk measurement: Credit risk arises when a bank borrower or counter- party fails to meet his obligations according to specified schedule in terms of predetermined agreement either due to genuine problems or willful default. Banks are using two broad methodologies for computing their capital requirements for credit risk as per Basel II guidelines. First…

Read articleWhat is capital adequacy framework?

Adequate capital is required by banks to absorb any losses that arise during the normal course of the bank’s operations. Each Capital contribution/Equity contribution is a contribution of capital, in the form of money or property, to a business by an owner, partner, or shareholder. The capital adequacy frame work in banking business emphasizes adequate…

What is capital account convertibility (CAC)?

Capital Account Convertibility means that the currency of a country can be converted into foreign exchange without any controls or restrictions. The Report of the Tarapore Committee on Capital Account Convertibility (1997) provided the following working definition of CAC: “freedom to convert local financial assets into foreign financial assets and vice versa at market determined…

Read article